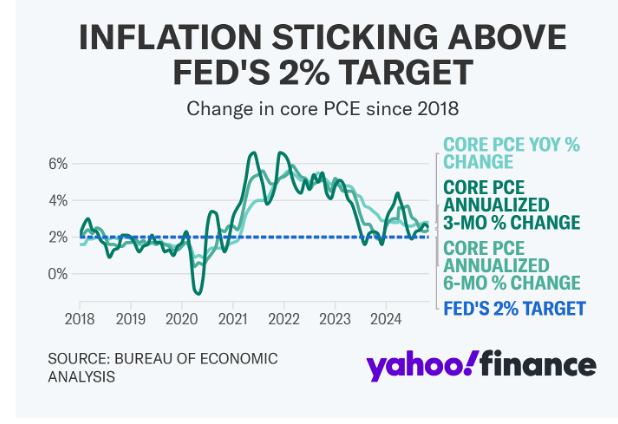

A second year of healthy growth for financial assets in the United States has, for most observers, put an end to talk of a “soft landing” or a “hard landing.” As I observed last quarter, the economy has landed, and the reason some have not noticed is because it was and is an amazingly soft touchdown. Put another way, despite a frenzy of government spending over the past four and a half years, our Federal Reserve Board was able to dampen inflation by raising interest rates without creating a recession. The inflation challenge has not been met, however.

Inflation fear is deeply embedded in the consciousness of Baby Boomers. This post-war cohort recalls the near-runaway inflation of the 1970’s. That inflation was ignited by “guns-and-butter” deficit spending of the Johnson presidency followed by Nixon’s unlinking of the US dollar to gold while accompanied by America’s dependence on foreign oil. It sparked discontent with Jimmy Carter’s presidency, as reflected in a cartoon from 1978:

The unwinding of high inflation required sky high interest rates and some deep recessionary months in the early 1980’s, a time when Boomers were launching their careers, trying to buy homes and cars, but were forced to pay interest rates in the teens to borrow.

This same generation today controls more financial assets than any other and are now retired or nearing retirement. Inflation is a threat to someone on a relatively fixed retirement income, especially with today’s longer life expectancy. Consider that a $100,000 lifestyle in 2024 will buy only a $50,000 lifestyle in 24 years even if inflation runs at only 3% per year.

According to updated economic forecasts from the Fed’s Summary of Economic Projections, central bank leaders see core inflation hitting 2.8% next year —before cooling to 2.2% in 2026 and 2.0% in 2027.

Inflation is also the third rail of politics today, as the recent election seems to have indicated. Republicans hammered Democrats by focusing on the price of milk and eggs. Inflation was likely the issue that drove many working class voters to the Republicans.

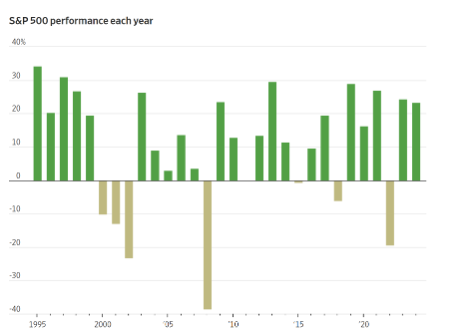

Financial assets, especially common stocks, soared post-election enjoying a “Trump Bump.” But that trend was already in place: markets repeatedly touched new highs throughout 2024 despite elevated interest rates, an uncertain election, cold war with China, and the cost of supporting Ukraine’s valiant self-defense. Meanwhile fears that oil supplies might be threatened by Israel’s war with its neighbors lurked in the background. Moreover, regulators around the world sought to tackle American technology companies with increased regulation, an effort that was joined by the current administration’s Federal Trade Commission and Department of Justice. Still, markets advanced, particularly technology related issues.

The United States is now the world’s largest energy producer, and home to some 75% of the world’s major technology companies. The USA issues the world’s reserve currency and sports the planet’s most lethal military. Warren Buffet attributes most of his success to the fact that he lives and invests in the United States. I agree with his assessment, which is why the majority of clients are invested in US companies.

With long term thinking, an investor in stocks is, in my opinion, bound to profit. But many people are spooked out of markets by the vicious bear cycles that do and will occur. The reason for owning a balanced portfolio is to provide a psychological cushion against panicky decisions at inopportune times. It also preserves cash during bear markets, allowing for purchases at better prices from others who are panic selling.

Economist Edward Yardeni, whose visionary opinions regarding macroeconomic conditions have been valuable to me, is quite optimistic about the economy.

He cites low unemployment, a rising GDP and, I suspect is glad for the Republican sweep in the last election.

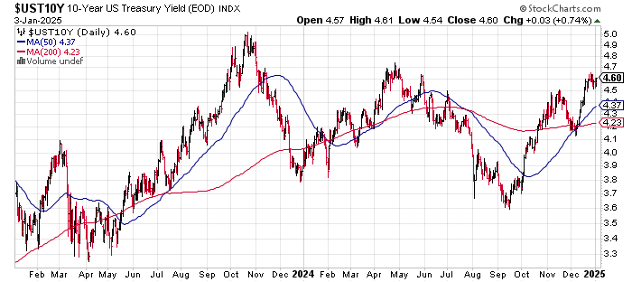

Compare Yardeni’s optimism to the concerns expressed by Jeffrey Gundelach, who manages the $30BB Doubleline Total Return fund. He, like most fixed income people is less sanguine and worries about the new Trump administration’s pledge to deport millions of foreign born workers and to impose tariffs as possibly driving a rebound of inflation starting mid-2025. Gundelach cites the recent surge in yields on US Treasury bonds as evidence that so-called “bond vigilantes” are already anticipating higher, not lower inflation ahead. As we neared year end, ten year Treasuries reversed their downward course, rising from 3.6% to about 4.6%, which is an exceptionally large increase (27%) in a brief period of time. If the discipline imposed by our independent Federal Reserve Board is challenged by the Trump administration, interest rates may rise further, and that is a threat to an expanding economy.

With a new administration coming into power, forecasting is especially difficult. Markets are looking forward to pro-business policies, but some proposals are causing consternation. The incoming president is known for his unpredictability. His cabinet nominations are not in place yet. Further, Republicans do not appear unified as to the best fiscal and tax policies. There is no certainty around how the economy will respond to some radically new ideas. This explains why many clients are seeing a historically high allocation to overnight money market funds, whose 4.25% yield, while not thrilling, is at least predictable.

Last year was one of the most eventful years in memory. Prominent features include a change of governments throughout the world, from Great Britain to Japan to the United States, and even to Syria. War dragged on in Europe too. China, Japan, and Europe barely avoided a recession. India slowed, Brazil was in recession. Yet throughout this year, the US stock market has chugged higher, driven primarily by technology issues.

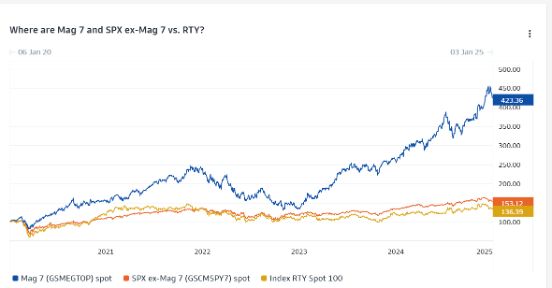

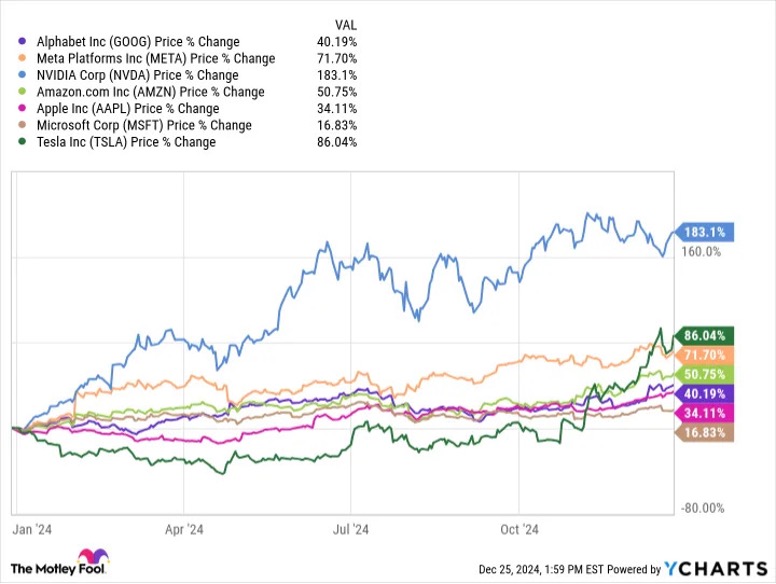

2024 was the second year where the widely followed S&P 500 stock index rose more than 20%. But the broad market has been less impressive: most of the heavy lifting was done by seven or eight stocks, nearly all technology related.

Source: Goldman Sachs

Source: Motleyfool.com

As might be expected from a balanced approach, our clients enjoyed a nice, low volatility year. While clients certainly participated in some of the prominent tech names my cautious approach meant relatively small commitments to these positions. Our holdings of foreign shares did little to contribute. And we closed some energy related issues with a loss. Some excellent, high yielding fixed income holdings were called in by their issuers. I’m not willing to lock in too many dollars now with investment grade paper yielding in the 5.0-5.50% range, since yields are trending higher.

At our December 9 client luncheon, I began by telling clients: “if you own assets and are among the wealthy, you’re likely to benefit from Trump 2.0.” That’s because the incoming administration wants to lower corporate taxes further, lower the capital gain tax and for seniors, remove the tax on Social Security, which has been biting ever more retirees due to its failure to adjust for inflation. But I also pointed out that economists worry about two key promises made by Mr. Trump: deportations and tariffs. Deportations could leave industries like restaurants and hotels, agriculture, and meat processing shorthanded.[1] Tariffs usually result in higher input costs for manufacturers and retailers, which are passed on to consumers in the form of inflation. The justification for tariffs it that it protects American companies and jobs. But this effect is unlikely to show up for at least 18 months, if in fact it shows up. While there are good things to look forward to, plenty could go wrong.

Adoption of Artificial Intelligence May Solve Problems

The broad adaptation of Artificial Intelligence (AI) in the economy is just gaining momentum. I liken this to the shale fracking breakthrough that revolutionized energy production in the early 2000’s. With that technological breakthrough, the United States was transformed from an aged oil producing nation with played out fields to the largest producer on the planet. This has given us a strong dollar and enormous power to affect world events, no longer kow-towing to OPEC.

Economist Edward Yardeni, mentioned earlier, attributes his optimism to the potential of Artificial Intelligence. Yardeni’s analysis awards responsibility for projected labor cost moderation to the adoption of AI throughout the economy:

“In our Roaring 2020s scenario, a productivity growth boom boosts real GDP growth, keeps a lid on inflation, drives up real labor compensation, and widens profit margins… we believe that the economy is in the initial stages of another productivity growth boom. This one has a lot going for it, especially lots of technological innovations that can augment the productivity of the available labor force in almost every conceivable business.”

As noted at our annual client luncheon on December 9, I personally am seeing a 20% efficiency improvement in my own work, which consists mostly of research, but also entails operational drudgery that I am happy to minimize. This is an astounding improvement in productivity in a very short time. Based on my own experience, I subscribe to Mr. Yardeni’s optimistic outlook.

The Washington Post recently ran a series on the adoption of AI to healthcare in the United States. The results bring hope of trimming the exploding cost of medical care while maintaining quality results. If you’d like to explore this phenomenon further the links below will take you to these articles.

Doctors are using AI. Will it make health care better or break it? – The Washington Post

Robots learn surgical tasks by watching videos – The Washington Post

A Personal Reflection

While 2024 offered a rewarding financial experience for clients and myself, 2024 is a year that for me is tinged with sadness. I’ve worked with many clients for decades, and this year a number of these fine friends passed on to a better place. Eileen and I feel these losses as we think of these people as friends and that this is more than just a business relationship. I’ve been honored to continue to serve the children and even grandchildren of clients who are now gone.

Wishing you a healthy, prosperous, and meaningful New Year!

Gary Miller

[1] While disruptive to the leisure industry, technology may find ways to replace many lower paid workers, a boon to AI and tech stocks in general.