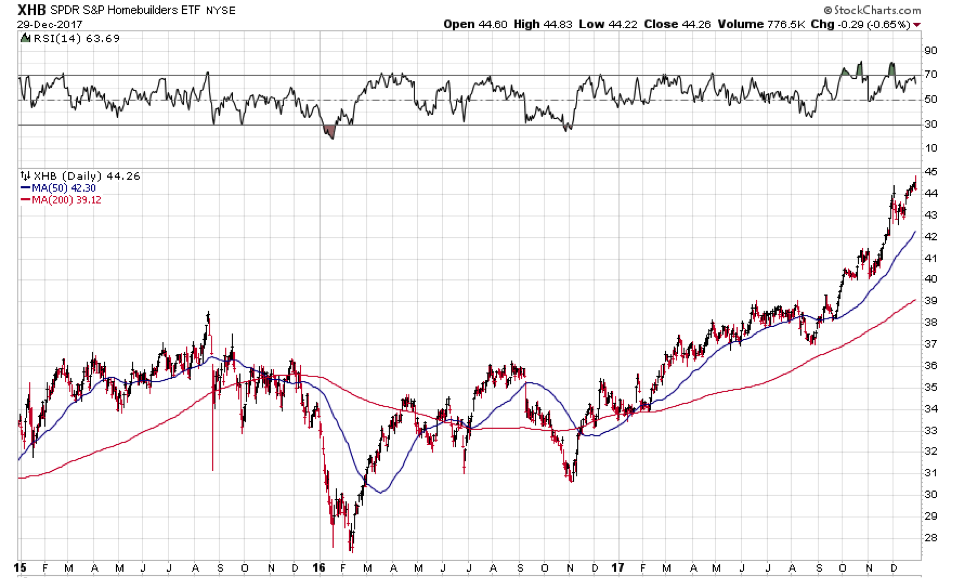

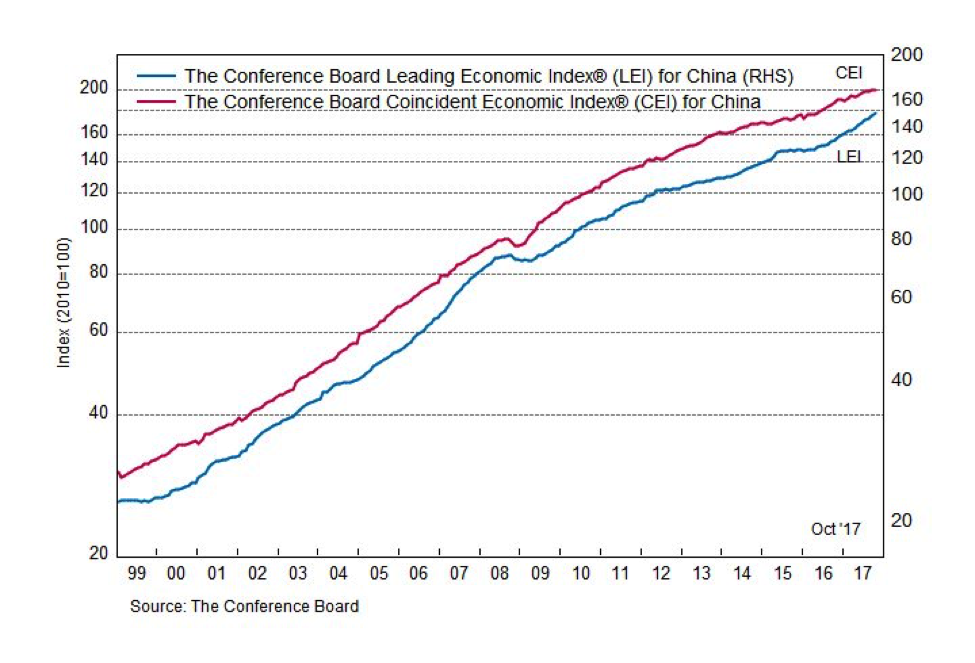

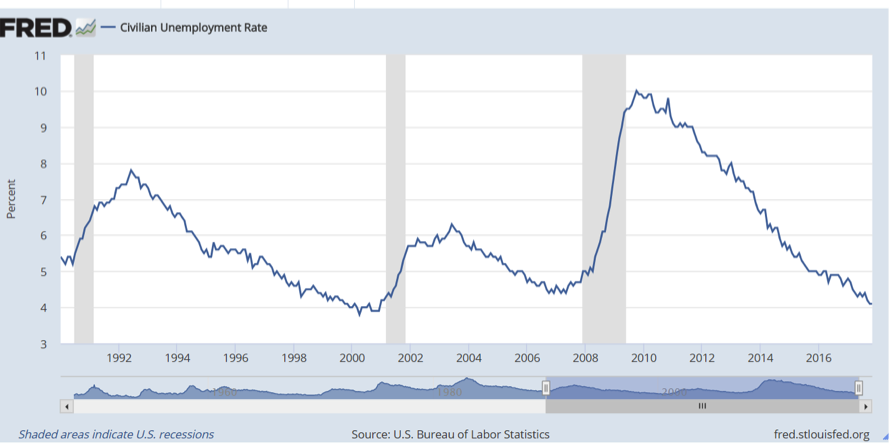

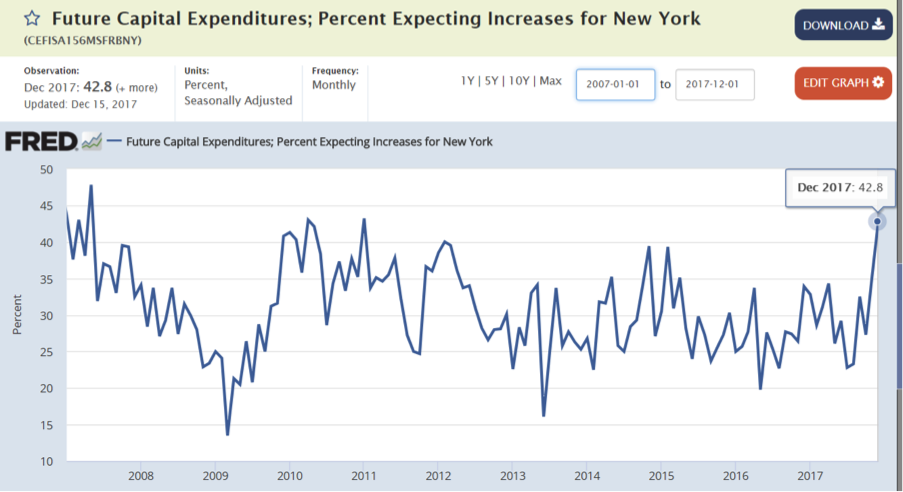

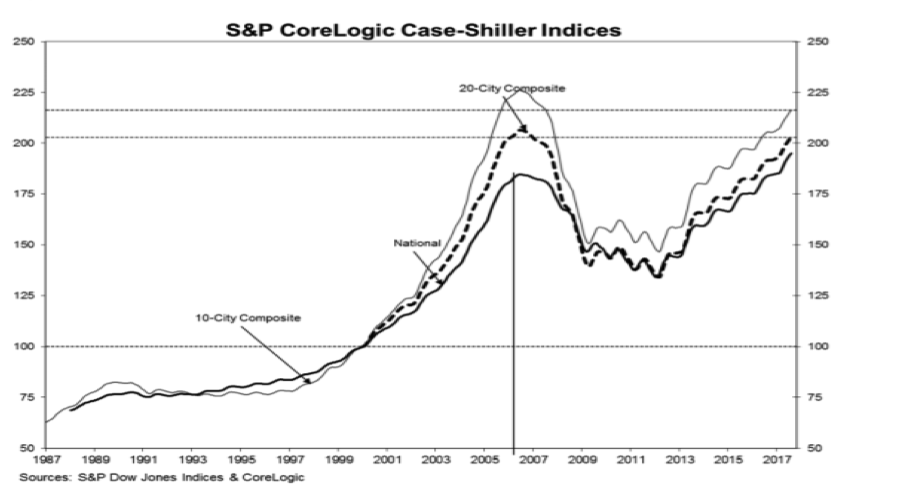

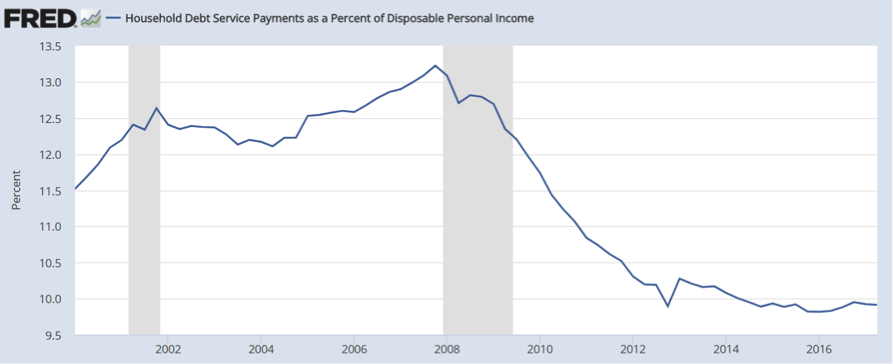

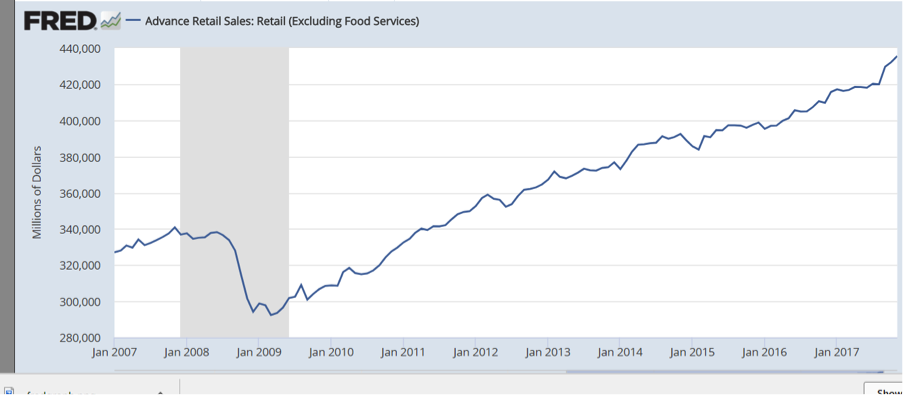

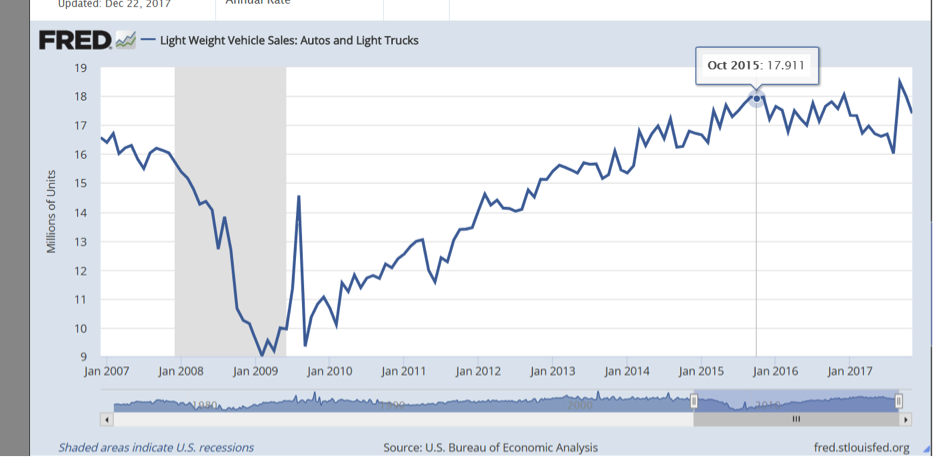

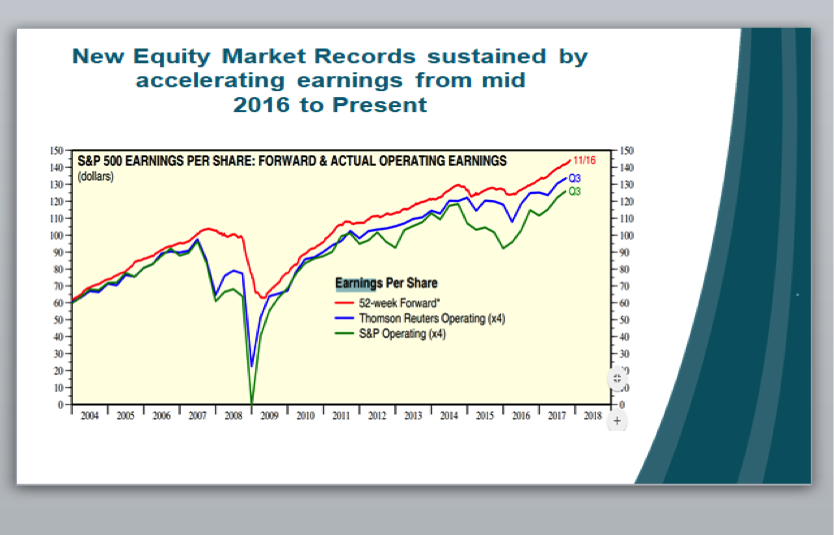

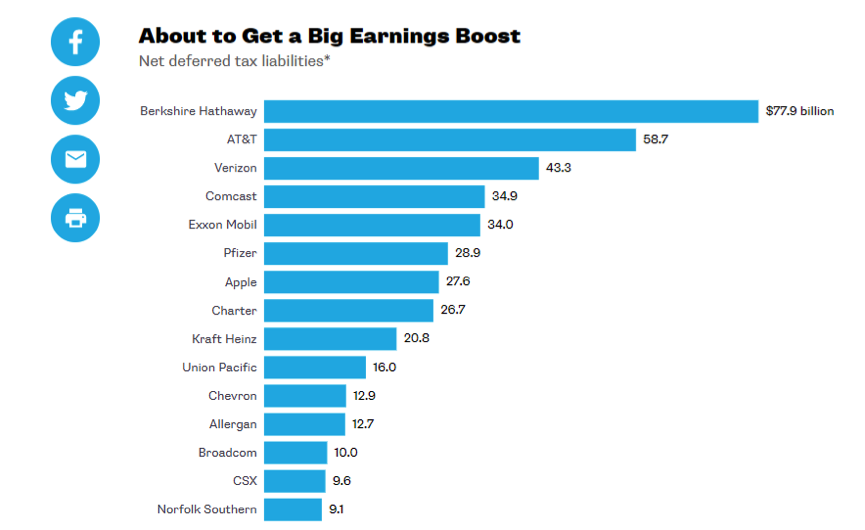

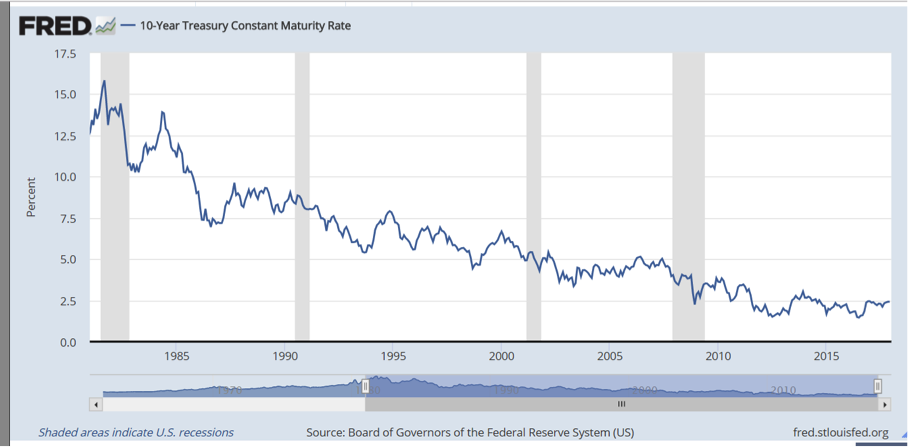

The year 2017 confirmed how difficult it is to project the course of financial markets. Any number of highly worrisome events characterized the year, yet financial markets: stock, bond, international, commodities and yes, Bitcoin seemed nearly impervious to bad news. The widely followed Dow Jones Industrial Average (DJIA) rose from about 19,700 to 24,700, its best performance in eight years. The Standard & Poors 500 was up about 22% for the year. Threat of nuclear war with North Korea, terrorist bombings, serious questions about public officials and unexpected exits from corporate boardrooms failed to put much of a dent in the upward march of equity indexes, both in the United States and internationally. Nor did rising short term interest rates seem to hurt investor sentiment or demand, even for bonds. It appears we are reaping the result of nearly a decade of massive monetary stimulus that has allowed tottering banks and other lenders to clean up their balance sheets. Along with the financial sector, a wide swath of corporations were able to swap high interest bearing bonds, issued before the crisis, by refunding with cheaper (lower interest bearing) financing. As confidence in equities grew, rather than issue more stock, companies were net buyers of their own shares averaging about $400BB in buybacks per year during the recovery period. Further, the steady and concerted focus by corporate management to rationalize their operations, has reduced overhead (often through layoffs, outsourcing and automation) has improved profit margins. Free market purists who opposed government intervention leading into the Great Recession, appear to have been proven wrong. Had monetary and fiscal measures of historic proportions not been applied to a collapsing system in 2008-2009-2010, it can be argued that the planet would have been plunged into a protracted depression. Today, U.S. auto industry is solvent, banks are again paying dividends, cyclical industries are doing well and confidence in most state government debt has been restored. Major U.S. stock market indices recovered within three years and the rest of the world, although behind us, is now in expansion mode. This occurred with little fiscal stimulus from new government spending[2]. Rather, the herculean task of pulling our economy out of the well was handled by monetary authorities. Source: Wall Street Journal online December 29, 2017 (www.wsj.com) Attempts at fiscal stimulus in 2011 by Democrats who wanted to encourage government subsidized infrastructure spending were largely thwarted by Republicans who then opposed government activism and opposed rising budget deficits. Historically, it has been the Republican Party that has argued for balanced Federal budgets and fiscal responsibility. Now, in the ninth year of economic expansion, the G.O.P. seems disengaged from its own history. Congress has just passed a law, called “Tax Cuts and Job Act.” The Congressional Budget Office, among others, predicts the new law will add $1.5 TT to the $20 TT federal deficit by 2027. This is disturbing to those of us who manage our personal budgets responsibly. Today, it seems, there is barely anyone in either political party who cares about the credit card bill being passed on to our children and grandchildren. But, for “the 1%”, the investor class, the new legislation seems to assure greater net corporate earnings, and a trickle down (perhaps a gusher) of rising dividends and share buy backs! Too Much of the Same? The U.S. equity market took a significant pause in 2015 before regaining its footing after March 2016. A distinguishing feature of the subsequent run-up, especially this year, has been a shift of money by investors into exchange traded funds (ETFs), most of it going into funds that buy the entire index such as the Dow Industrials or and Standard & Poor’s 500. These indexes are capitalization weighted, thus, the higher a stock rises in relation to the market in general, the more it must be purchased by an ETF seeking to mimic the index. Technology companies like Facebook, Amazon, Apple, Netflix, Google and Microsoft have seen their sales and in most cases their profits soar, so individual stock buyers have been focusing on these names. But a whipsaw effect appears to be in motion. The more a technology stock rises, the more demand generated by ETF’s. This is reminiscent of the run – up to the Tech Bubble, when actively managed mutual funds crowded into names like Yahoo, Network Appliance and Cisco, driving valuation ratios to absurd levels. This is not to deny the revolutionary and sometimes profitable ideas and capabilities that tech firms offer society (Apple iPhone is just 10 years old). But one must be alert to herd behavior when choosing what to own. Our client portfolios are not tech heavy, but with exchange traded funds well represented, exposure to tech is inexorably growing, so we are cautiously watching developments. There are sectors other than technology that will serve investors well. The financial industry, especially regulated banks, have been allowed to resume paying dividends, as they are all passing “Stress Tests” established by the Federal Reserve and the Comptroller of the Currency. Insurance companies like A.I.G. may, under pending proposals, be excused from the highly regulated status of “Systematically Important.” This bodes well for stocks in the sector. Likewise, rising world oil prices have breathed life into the energy sector which appears to be leaving a two year bear market behind. But lest we become too bullish on the sector, energy is still very much exposed to the unity or disunity of OPEC producers. Many economists thought the homebuilding sector would catch fire before this, but 2017 was finally the year that housing and building related stocks caught a bid. This uptrend is likely to accelerate, as Millenials, deep into the family-forming stage of life, are looking to get out of their parents’ basement and into that white picket fence in a nice neighborhood. Of course, technology companies gathered most of the attention in 2017. The graphic below shows the big winners of 2017 in green. The greater the gain the larger the block awarded: As can be seen, Apple was a star performer in 2017. However, diversified investors, such as ours, may enjoy the graph below, a telling three year chart comparing the price action of Apple computer (AAPL) and that of Berkshire Hathaway (BRKA). Berkshire is a company that owns and invests in a broad swath of economic activity from insurance underwriting, to railroading, to furniture sales and rental. Who says one has had to own a lot of tech to make money? Source: www.Stockcharts.com The Economy appears Healthy Most indicators are positive, as are most key measures of economic health here in the United States. Here are a few charts to underscore this point: Leading Economic Indicators Near record-low Unemployment Historically, when unemployment is low and people feel secure in their jobs, when the value of household assets, particularly homes, is rising, consumers feel optimistic and are more likely to loosen their wallets. Here is a widely followed index of home values in the USA: As home prices have generally returned to pre-Great Recession levels, consumer confidence has improved – the so-called “Wealth Effect.” But, unlike the lead up to the previous financial bust, there is little evidence that people are borrowing equity out of their homes for frivolous purchases. This recovery is not built on a shaky foundation of household debt and that’s a good thing. Here is a chart that represents the level of household debt as compared to income: After some post – recession reticence, Consumer spending has trended mostly upward since 2010. This year, consumer spending appears to have accelerated. Auto sales took a brief pause, then resumed their impressive growth Outlook for Equities Stocks are by no means the only vehicle we use to sustain and improve client performance. But it appears we are in a sustainable bull market, so naturally the question arises: will 2018 be another great year for stocks? For all the reasons cited above? I suspect the answer is “yes.” Underpinning the markets, so far, are real positive growing corporate earnings: The next leg up for the market may be driven by surprisingly strong earnings reports from the companies shown below, who have been deferring tax liabilities on their balance sheets. With a lower corporate tax rate, companies must, under GAAP[3], adjust their balance sheet entry of “deferred tax liabilities” downward, which will reflect as “earnings” on the Income statement. No one is sure how the market will react, but lower corporate taxes must logically be good for the outlook for corporate earnings, thus positive for the stock market. Bloomberg.com put it this way: “Tax Bill Will Deliver a Corporate Earnings Gusher” (December 27, 2017). The unknown from this once-in-a-generation event is what will corporations do with their tax savings and bloated U.S. working capital accounts? Will they expand production? Expand Research and Development? Pay off debt (= downward pressure on interests rates)? Hire more people in the USA (further reduction of unemployment, improved consumer spending, including on housing)? Buy back stock (great for the market and for the Investor Class)? This also begs the question: are all of these possibilities already reflected in this fully valued market? Some are betting that a sharp reduction in the highest marginal corporate tax rate will spur economic growth unseen since the early 1990’s. But a survey by the Wall Street Journal of some 60 economic forecasters[4] indicates this is not a widely shared view. Expansion is expected to continue for another three years, but at about a 2% growth rate. While certainly positive, these economists do not reflect the optimism of Treasury Secretary Steve Mnuchin who has suggested growth rates of 3%-4% or higher. Who will the markets believe? Outlook for Bonds Bonds, especially when used by skilled money managers, have provided a healthy return to most clients for many years. Bonds do well while interest rates are falling. We tend to forget that they have been falling since the 1980s: Bond values struggle when interest rates are in a secular period of increase. While I do not know if we are about to enter such a period, it appears likely that the easy money has already been made in bonds. Government and high grade corporate bonds should be seen as a place of refuge and stability, but not necessarily as a driver of portfolio gains. Never-the-less, we believe in portfolio diversification, asset protection and low volatility. Therefore bonds will continue to be well represented in client portfolios going forward. International economies Improving in the wake of the U.S. Expansion Europe, Japan, China and South American countries are on an economic upswing. It has been a long time since so many places were growing economically all at once. This has to be good for equity values and also for commodities like oil, copper, steel, lumber and more. We have been stepping into some direct international exposure for some clients, but the pickings have been so good in the USA that we do not feel compelled to make a heavy allocation to international company funds. Fear Not Cash We have endured a long period during which funds left in money markets have paid nearly nothing in the way of interest. This has changed with last year’s numerous increases in short term federal funds rates. One year certificates of deposit can be found yielding 1.50% or better. This remains a losing investment, after tax and after inflation erodes buying power, but it does represent an improved picture for those uncomfortable with taking any risk. We have always believed that when markets offer few risk related opportunities or when they are stressed, there is nothing wrong with moving some of your investment money into a money market fund or short term CD. At present this does not seem a smart strategy, but we like to mention our willingness to go to “cash” as part of an investment strategy that has worked for many of our clients over the years. Summary So, to sum up a lot of moving parts, there appears to be little danger of an imminent bear market, although a correction, even of 10% (for equities) is always possible. This market is not generally cheap, but housing, banking and energy seem to have room to run. 2018 appears likely to be a positive year for stocks, a “meh” year for bonds and quite possibly a strong year for commodities and commodity producing corporations. There are still opportunities to make money! Gary Miller, CFP [1] When then Federal Reserve Chairman Ben Bernanke merely talked about tapering off on extraordinary bond buying in 2013, this began a significant correction in the bond market. [2] Although social safety net measure, emplaced in the decades since the Great Depression of the 1930’s, such as unemployment insurance and Social Security to name two, had the desired effect of reducing hardship while exploding deficit spending. [3] Generally Accepted Accounting Principals [4] Wall Street Journal December 2017 Economic Survey, Copyright © 2017 Dow Jones & Company, Inc. All Rights Reserved

Outlook for Spending by Business

Year end 2017 Overview and Outlook

[1]