Our clients’ managed accounts were up a fraction of a percent in the quarter just concluded, in line with the quiet performance of both stock and bond indexes. While we are still compiling the figures, it appears a composite of size weighted client portfolios averaged between 9% and 10% per year over the past five years.

The Markets

Following the explosive upward action in equities that capped off a healthy 2014 for long positioned investors, the first quarter was burdened by three albatrosses: A large portion of the country, particularly the Northeast was socked by repeated snowstorms and extreme winter weather that kept shoppers at home and construction activity frozen. On the West Coast, the Longshoreman’s union battled management in a slowdown/strike that cost retailers at least $7BB in lost sales and countless $ billions for farmers whose exports were delayed or cancelled. Meanwhile, the business media, lacking solid news, over- hyped the importance of an anticipated Federal Reserve Bank overnight interest rate hike beyond rationality. While the valuation of equities and the forward motion of the economy are, to a significant degree, negatively affected by sharp increases in interest rates, the small and incremental measures contemplated by the Janet Yellen – chaired Federal Reserve Board are hardly something that would take our growing economy into a recession. Those of us who lived through the years of the Paul Volker Federal Reserve recall mortgages at 15% and treasury bonds at 16%, so it’s difficult to get worked up about mortgage rates rising to perhaps 5.25% to 5.5% basis points over the next 12 months.

Although a 10% correction is certainly a possibility, as we enter a seasonally weak period for equities, my principal concern is lack of truly undervalued equities and the challenge of finding decent yields on fixed income instruments. Thus, we retain about 10% cash in Client portfolios.

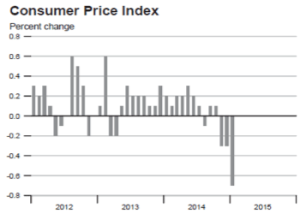

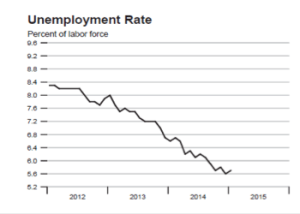

Let’s emphasize our basic viewpoint: the U.S. economy is healthy and we are not at risk of an unsustainable boom. Underpinning the good news is falling unemployment and low inflation:

Activities during the First Quarter 2015

Our clients’ portfolios saw relatively little turnover in the quarter. We rotated out of two bank holdings, at a profit and into another, paying a 6% dividend. We closed one position taken last summer, Priceline, at a loss, as the anticipated benefit of a relationship with China’s largest on line travel web site has been slow to materialize, and the company appears to have overpaid for Open Table. On the other hand purchase of a major credit card processor holds the promise of growth in an expanding US economy, where unemployment is nearly back down to pre-recession levels and consumer confidence is up. We also added a tire company: boring perhaps, but think about it – with gasoline prices down we can anticipate a lot more driving and thus an acceleration in the tire replacement cycle.

As you know, we are not “traders”, but want to be long term owners of businesses with superior characteristics: a unique competitive advantage (AKA a “moat”), high returns on equity, high free cash flow and capable management. Our tendency is to hold on to solid names even during periods of doubt. For example: energy pipelines. As our clients know, we invested in our first pipeline in 2003, and still hold a position with the company. This investment has seen some down periods, notably when oil and gas prices fell sharply, as they did during the Great Recession and as they have recently. But over those twelve years this investment has grown at an average annual rate over 17%. Knowing when to “hold ‘em” can be rewarding!

One of our larger positions is with Apple computer. The firm’s highly successful introduction of a larger format iPhone (6 and 6s) has been greeted with enthusiasm, leading the company to snatch the crown of top smart phone sales back from Samsung, for the time being. The stock responded accordingly, achieving an all time high during the recent quarter before correcting slightly. By most measures it is far from overvalued. (As an example, Apple trades at 6 times book value while another beloved, innovative company, Tesla, trades at 26 times book).

We try to remain ever aware of demographic trends that create opportunities to profit our clients. One of those trends is our steadily aging population. Age brings rising demand for medical services and pharmaceuticals. We’ve had success with a number of pharmaceutical companies and more recently with funds holding a diversified portfolio of pharma, medical devise and medical technology companies. In the quarter just past one of our holdings was up 6% the other up 15%. While one quarter of strong performance does not guarantee that the entire year will be as exciting, I am confident that our aging population makes this space a good place for some of our clients’ money.

Speaking of demographics, we are entering an era when Millennials (people born between 1980 and 2000), 85,000,000 strong, will be seeking home ownership as they reach their late ‘20’s and early ‘30’s, often forming families. Things are setting up for acceleration in sales for publicly traded home building companies. However, none of these appear to be “values” (that is, having the characteristics mentioned above while trading at a discount to intrinsic value. We’ll probably nibble at a homebuilding stock soon, but without a major commitment.

Time Testing Our Advice

Our Trusted Advisor Newsletter dated April 2009, makes an instructive read. In hindsight, it was published at what turned out to be “the bottom” of the equities cycle, but neither we nor anyone else (who is candid) realized it at the time. However, we did wave the banner for bond buying, and were in the midst of acquiring some high quality issues for client portfolios, often with yields in the 9% plus range (e.g. General Electric). Tax free muni bonds were available for 6% and these were packed into taxable portfolios. These yields are unheard of today, at least for high quality debt instruments. In March 2009, I expressed doubt that we would have a sustained equity rally (wrong), but we held on to quality names through the Panic and our clients were able to recover their pre-crash portfolio values within 1 year. By comparison, it took the S&P 500 Index an additional 20 months to achieve the same feat1. That six year old newsletter is a reminder that the #1 job at Trusted Financial is to minimize the damage from inevitable market cycles, while being willing to take reasonable risks when others are paralyzed and passing up bargains. Even with our cautious approach, many Balanced/Value portfolios have approximately doubled in value since March 31, 2009. Please read that Trusted Advisor April 2009 Newsletter, written at a crucial turning point for our economy, as it may give you some insight into our approach and why we’ve been able to garner the positive reviews from clients that you will find at this website. Thanks for reading!

1 This statement is based on our Size Weighted Composite of client portfolio performance, continuously published since inception of Trusted Financial Advisors and available for inspection upon request.