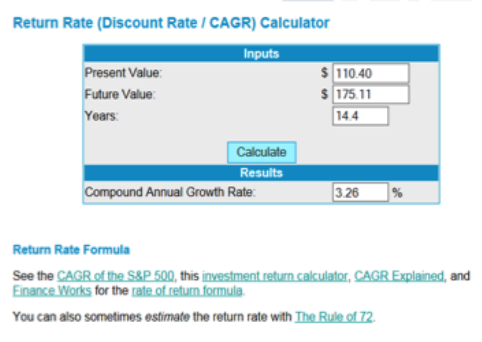

The bursting of the real estate bubble during the Great Recession educated many investors: real estate is just another investment. Real estate, particularly rental real estate, is a Christmas tree promising lots of gifts…for those who sell, service, charge fees and tax property! When stripped of the hype that is churned out by local and national real estate sales organizations, real estate is not a particularly attractive investment. In fact, the widely respected Case-Shiller U.S. National Home Price Index , published by Standard & Poors indicates that between early 2001 and mid 2015 the average annual increase in home prices was just 3.26%.

Source: S&P Case- Shiller (www.us.spindices.com/indices/real-estate/sp-case-shiller-us-national-home-price-index)

While this nominal growth rate matched inflation, this is not a complete picture: As an investor, don’t forget you must pay annual property taxes, insurance, repairs and you have the pleasure of dealing with the plumber, the electrician, the gardener and… your tenants. I say this as a former landlord who knows. Rental property only makes sense if you earn a significant positive cash flow after all expenses and allowance for periodic vacancies. If you depend on price appreciation for your return, history suggests you will be disappointed.

During the same period that home prices nationally were plodding along, Trusted Financial Advisors’ Balanced Value Accounts

[1] Source: Portfolio Center™ Size Weighted Composite of all Balanced/\Value style accounts, March 31, 2001 to September 30, 2015.