As your statistical report will likely show, this has been a nice quarter, a nice year and a nice twelve months for most clients. While technology company shares took a breather and went into a consolidation phase, a broader cohort of equities saw renewed interest and resulted in an overall positive performance of both domestically focused and international mutual funds. The widely followed Standard & Poor’s 500 index reached an all time high:

Bonds and preferred stocks, the “balancing” portion of most client portfolios, also rallied in reaction to the official reduction in short term interest rates initiated by the US Federal Reserve Board. This was echoed by many foreign central banks as well, boosting non-US stocks. Meanwhile, the US labor market remained healthy. In response, investors began pulling some cash off the sidelines to buy equities and precious metals.

2024 began with frequent discussion among pundits questioning whether higher interest rates would prompt a recession, but this talk has been largely dispelled– defying those expecting a recession, the Federal Reserve clearly has stuck a ”soft” landing worthy of Simone Biles. I’ve come to feel that these will be remembered as Charles Dickens put it, “the best of times.” As the quarter ended, the immediate worries facing financial markets were an East coast longshoreman’s strike, a possibly widening war in the Middle East and the November elections. Yet the major global markets finished strong.

The S&P 500 total return is about 22% year -to- date but the Dow Industrial Average is up only 12.3%. This suggests that more traditional cyclical stocks have not done as well as the S&P which is now weighted so that about 36% of the index consists of just seven technology related issues. This is one of the most lopsided weightings in history.

Our client portfolios are “balanced.” Clients now hold the highest percentage in common stocks since before the Pandemic. Most are seeing returns year to date around 10%. As clients understand, a balanced portfolio will rarely out-perform a “stocks-only” portfolio during a bull run. More importantly, when a Bear Scare runs down Wall Street, a balanced portfolio will usually hold value better than stocks.

An alert Advisor is Good Value:

A significant source of growth this year is derived from elevated yields available from certain money market mutual funds. All clients have a “sweep” feature: when a dividend arrives in your account, for example, it is “Swept” into a short term money market fund. But many are not aware that with a bit of effort, these funds can be moved into so called “purchased” money market funds with considerably higher and nearly risk free yields.

After the Great Recession (2007-2009) investors became accustomed to receiving paltry interest income on money market funds. When inflation began to roar in 2022, hitting about 9%, the Federal Reserve raised short term interest rates with the goal of bringing inflation down to an acceptable 2% level. The overnight Fed Funds rate rose to 5.5%. So, a bank could park money with the Fed and earn 5.5%. How much did they pay you for use of your money? Most brokerage firm sweep money funds and bank money market funds continued to pay rates below ½ of 1%!

Better rates became available to those astute enough to move their cash into so-called “purchased” or overnight money funds. Pro-active money managers, like yours truly, re-positioned much client cash so as to garner those better yields. This is a manual process, it takes time. I began repositioning client cash by mid-2022, before most folks realized the new, higher yielding opportunity.

If you have other accounts with other advisors or unadvised accounts away from my management, may I invite you to review how well they’ve taken advantage of short term interest rates since 2022?[1] I’d be happy to invest that money more efficiently for you.

Update: Inflation has come down and the Federal Reserve is reducing short term rates for banks by pegging the Fed Funds rate lower. As of quarter end, Charles Schwab’s overnight money funds were yielding between 4.6 and 4.75%. This is still an attractive risk free[2] yield. Overnight money market funds are superior to certificates of deposit for parking what I term “ready money.” There is no lockup, no penalty for early termination. The only restriction of getting money out of purchased money market fund is the one day delay required for sale of the fund to turn it into cash.

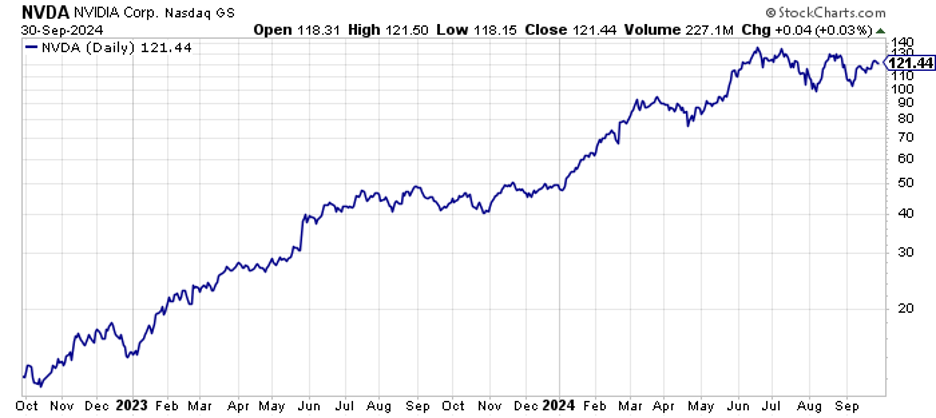

Nvidia pauses

Last quarter, I highlighted our happy results from owning Nvidia. Many clients own this company by holding the common stock. Others own it through a fund such as Van Eck Semiconductor or Parnassus. When the company reported its results for last quarter, investor enthusiasm appeared justified as revenue leaped 15% in just one quarter and is up 122% from last year. Few companies have ever grown earnings that fast. Nevertheless, during the quarter, the stock dipped by about 35% before a partial recovery. Why?

Profit taking is a normal occurrence after a stock has a big rally, but Nvidia’s correction was likely exacerbated by an announcement that the US Department of Justice began an investigation of allegedly monopolistic practices.

Nvidia’s success is driven by innovation. They have drawn ahead of competitors such as Intel, Samsung, and AMD by producing super-fast chips and systems that lend themselves to training artificial intelligence. It is interesting to note that Intel Corporation (INTC), believed to be far behind Nvidia in chip design and fabrication, is the beneficiary of a government handout from the CHIPS Act,1 while Nvidia is apparently under attack by the same government.

Nvidia currently enjoys about 80% of the sales of semiconductors for artificial intelligence (AI) training. If this had been achieved by putting competitors out of business or via subsidies from government, the Department of Justice investigation might be warranted. But this does not appear to be the case. The company dominates by being the best at what it does. Those of us who believe in free market efficiency believe it may not be a good thing for consumers or for society when government operatives get to choose winners and losers in the economy.

My view is that the negative noise doesn’t end a secular bull market for this innovator. I added to some client positions and even brought new positioning in Nvidia to some client portfolios.

Tech Stocks under Assault

It’s not just Nvidia under assault. It seems our government, through both the Justice Department and anti-trust watchdogs like the Federal Trade Commission is focused on America’s champion technology companies. But an even more focused assault from Europeans has been under way for some time. Here is a sample of headlines seen this recent quarter:

It is not surprising that foreign governments devote resources to attacking American companies but I am surprised that the US government has piled on. Unpredictable investigations and legal maneuvering complicate financial analysis, and in fact contributed to the decision to exit Alphabet (GOOG) discussed below.

Out of Alphabet (GOOG) and In to Amazon (AMZN)

Alphabet (GOOG), parent of Google, is a monster company with tentacles into a wide swath of the economy. Business divisions include Google Search, YouTube, Android operating system and Waymo (self-driving vehicles). However, Alphabet has performed poorly this quarter. When the share price violated the 200 day moving average of closing prices, it triggered my “sell” muscle. My reason for exiting the GOOG was not simply due to technicals. As highlighted earlier, tech stocks are in the cross hairs of governments both here and in Europe. Google was forced to leave China some 14 years ago because search results exposed the rot and incompetence of the communist dictatorship, and as noted European and now US governments are circling the company looking for privacy violations, scraping of AI data without permission and monopolistic positioning.

In deciding to exit GOOG, my own experience with a competing search engine, known as Perplexity.ai, convinced me that Google search, the most profitable driver of Alphabet’s revenue, may be under serious competition for the first time in about two decades. I was introduced to Perplexity.ai earlier this year and find it provides a wider and more accessible menu of results than Google. It is now my “go-to” search engine, and its paid user base, according to CNBC, is exploding.[3] Further, European regulation now requires websites to ask permission to access your personal data and to follow you[4]. Tracking blockers like BitDefender thwart privacy intrusion. Alternative search engines like DuckDuckGo do not track users. Google search depends on tracking.[5] These developments suggest a serious challenge to Alphabet’s growth.

Alphabet is plowing more money into building out its cloud platform than every other tech company except Meta. This holds promise for Alphabet’s future, but for now implies less free cash flow available to buy in stock or raise dividends. These worries were already my concern when the stock busted below its 200 day moving average for the first time in 20 months, triggering the decision to sell.

Most clients will recall that Amazon (AMZN) stock was very good to us from 2016 until 2022 when it began a major correction. With management changes and a renewed emphasis on bringing the company’s massive sales revenue to the bottom line, the stock has again become interesting. I picked up a modest allocation of 3% of portfolio value for certain clients and it also resides in many smaller portfolios via mutual funds.

The company has been a loss leader for most of its existence, choosing to plow back free cash flow as it expanded from an on line bookstore, to a on line general merchandizer to a content provider and then a major “movie” studio, when it acquired MGM. The company’s Prime Video is now giving serious competition to Netflix and other streamers. The real profit maker is Amazon Web Services (AWS). AWS is a cloud service that rents server space out for use by enterprises, government and whomever needs to manage their business from the cloud. You’ve no doubt heard about the Cloud for years. Amazingly, it is estimated that some 40% of US businesses still use local storage, so there is room for continued growth in cloud server demand. Moreover, the era of artificial intelligence had accelerated the need for reliable computing power, and it is believed AI will drive a nearly insatiable demand going forward. For those interested in more background check out this link to a recent review of the company in The Economist: Amazon has Hollywood’s worst shows but its best business model (economist.com)

https://finance.yahoo.com/video/amazon-looks-better-near-term-110002693.html

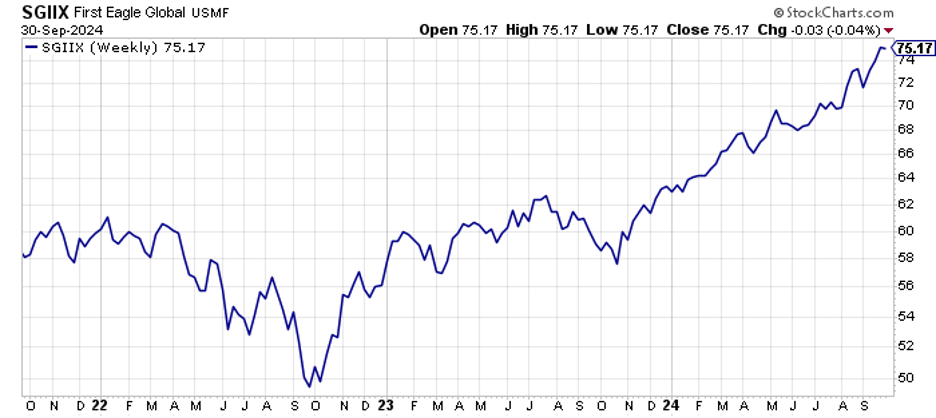

International Investing

Most clients will notice an expansion of foreign stock holdings. This is driven by my belief that falling interest rates and oil prices are good for the global economy, not just the USA. India is a rising star as western investors feel more confident investing where the government supports entrepreneurship and capital formation. Japan appears willing to reform its capital markets, although with a change in government I’m taking a wait and see attitude, holding our limited investment there. First Eagle Global Fund (SGIIX) has been generating great results in a diversified and well managed portfolio, so I’ve expanded client exposure to this fund.

Please note, clients have not direct interest in Chinese companies. I’ve opined in other reports that China’s opaque reporting (which has recently become even more opaque) and corrupt or mismanaged economy makes it too risky for investment at this time.

Gold Glitters

We’ve been in and out of gold related funds more than once since I became an independent Registered Investment Advisor. With a half century of experience, I have come to agree with Warren Buffet that gold and other precious metals are not great long term investments. They generate no income and, contrary to what TV promotions tell you, precious metals have failed to offset the deleterious effects of inflation over the fifty years since gold ownership was legalized in the United States[6].

However, gold’s nominal value, expressed in U.S. dollars can, in the short term, counter balance a dollar that is weakening relative to other currencies. That’s exactly what is happening this year. As the dollar’s exchange rate softens, gold has taken on a new life and actually registered a new all-time high dollar price[7] Consider the two charts below showing the value change of the US dollar (green) vs Gold (gold):

So, for some client portfolios, the SPDR Gold exchange traded fund (GLD) has been added with a small allocation of about 3%. So far, a weakening dollar and tensions in the Middle East are making this investment profitable. We may have even begun a secular (very long term) bull market, given the irresponsible promises of both presidential candidates whose proposed tax cuts (Trump) and spending promises (Harris) will balloon our fiscal deficit further.

MARK YOUR CALENDAR: Annual Holiday client luncheon will be on December 9 at 1:30 PM, at Capital Grille, Costa Mesa. Invitation will be sent in late October.

Cybersecurity Awareness:

We’ll soon be implementing some additional measure to insure better protection against cyber criminals. In the meanwhile, it would be to everyone’s benefit to honor the guideline on communications with Trusted Financial below:

We discourage use of texting for communication, especially with regard to fund requests and trade orders. These should always be directed to our email address: gary at trustedfinancial dot com and angela at trusted financial dot com. Our emails are scooped into our client management software for archiving. This protects both you, client and ourselves in the event of possible misunderstandings.

You’re also encouraged to use our client portal for uploading documents to us and for retrieving any reports, such as the quarterly statistical report that has just been generated for the quarter ended September 30, 2024.

Gary E Miller, CFP

[1] For your interest, this links to an article reporting there are class action lawsuits in process from investors who feel their funds were mismanaged by advisors who failed to switch into overnight funds as interest rates rose: https://www.fa-mag.com/news/three-new-cash-sweep-suits-hit-ameriprise-and-lpl-79281.html

[2] Purchased money market funds are not actually risk free, unless all of the assets in the fund are invested in government notes and bills. From a practical standpoint, however the risk in these funds is extremely low.

[3] https://www.cnbc.com/video/2024/10/03/perplexity-ceo-aravind-srinivas-talks-its-ai-search-and-advertising-strategy.html

[4] GDPR: The General Data Protection Regulation, implemented in 2018, requires explicit user consent for data collection and gives users more control over their personal data. This is being reflected here in the States-when you try to sign in to a new website, you will notice you are now asked for permission to accept their cookies and tracking. I suspect most users opt out from marketing cookies and this will likely hurt Google search.

Cookie Consent: Websites operating in the EU must now obtain user consent before setting tracking cookies, potentially limiting Google’s ability to track across sites

Right to be Forgotten: EU citizens can request that Google remove certain search results about them, limiting the company’s data retention

[5] https://www.thenationalnews.com/future/technology/2024/09/04/googles-search-monopoly-under-threat-with-gen-ai-advent/

[6] https://www.investopedia.com/gold-price-history-highs-and-lows-7375273

[7] If this appears to contradict the earlier statement that gold has not been an effective inflation hedge, let me clarify that in terms of buying power within the United States, inflation has run ahead of the buying power of gold. In contrast, relative to the exchange rate for the US dollar, gold has recently rallied.