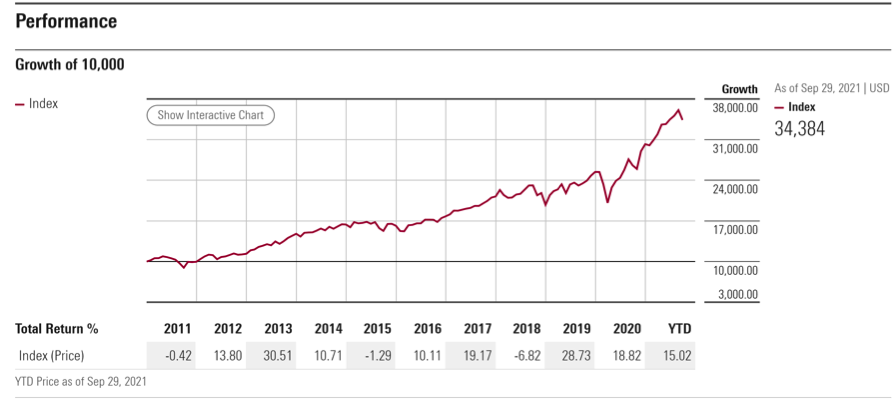

Stock market performance – the long view

This performance graph below, compiled by Morningstar and comprised of over 95% of US stock market listings, is a reminder of how well stocks have performed for the past ten years. A hypothetical $10,000 investment made ten years ago has more than tripled during one of the greatest decades for stock ownership in history.

Signs of Market Speculation – how will it be corrected?

Markets are higher for the year, and I remain confident in the potential for client holdings, but attention to signs of danger are always to be considered, and there are plenty. Many years of government support for financial market stability have led to a “what, me worry?” mentality among certain investors. Other than the brief Covid 19 – inspired crash in March of 2020, the market’s trajectory has been strongly upward, a trajectory that this tepid quarter has not changed. However, there is a long list of worries that, until recent weeks were generally ignored by stock investors.

- A resurgence in Covid 19 cases

- a labor shortage, slowing completion of projects

- a shipping bottleneck with resulting supply shortages

- China’s retrenchment from capitalism and a slowing of their economy

- clear evidence of too much froth in financial markets.

- Declarations by the Federal Reserve Bank that it will taper back bond buying

- Likelihood of higher taxes on corporations and individuals

- World wide natural gas bottlenecks threatening to slow growth for a range of economies

- Politicians and regulators attacking technology companies that dominate stock market indexes

Amid this important list of threats to economic growth, we’ve not seen a collapse in share prices. Are the worries overblown? Perhaps market resiliency derives from the fact that there are few good liquid alternatives to stocks, other than low interest paying bonds and wild commodity or crypto related investments?

Although stocks have had a nice year and even managed a small gain for this recent quarter, traditional measures of froth are abundant.

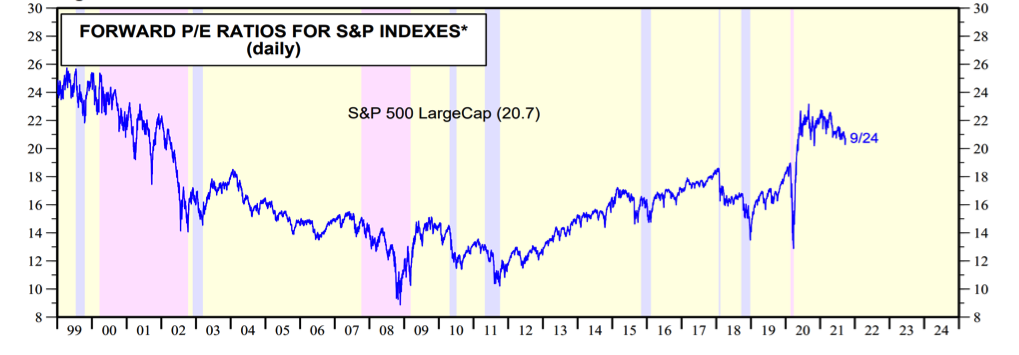

The best known indicator of market valuation, the price-to-earnings ratio, is approaching “Dot.com” Bubble levels:

Source: Yardeni.com

Investors have gravitated toward powerful companies with pricing power- giant technology firms like Microsoft, Google, Apple, Amazon, Facebook, etc., and we are among them, but we were usually ahead of the Crowd, having first positioned in Apple in 2014, and in Microsoft and Amazon in early 2016, when their price earnings ratios were more reasonable. These companies have exceeded expectations, and remain in secular growth trends that may moderate, but appear unlikely to end. Each Big Tech company offers a suite of services and or products that are making daily life more efficient, more enjoyable, more necessary to daily life. This makes for customers who are “sticky.” Each company has created an ecosystem that keeps customers invested in their products and willing to pay recurring fees. Wall Street, and this analyst, love recurring fee businesses. Toll road enterprises have more regular cash flow than those that depend upon a one time or occasional sale. Subscription revenue, pioneered by the likes of Costco, offers visibility to future revenues and thus future stocks prices for such companies are more predictable. Amazon derives repeat business and annual fee from its Prime membership. Apple sells subscriptions for its app store offers, and provides, at a fee, cloud storage for your photos, music and data. Both Microsoft and Adobe software are now offered only by annual subscription. The majority of our clients’ common stock holdings are in companies of this nature, and we intend to own them for a long time. Still, I’m not one to fall hopelessly in love with a company or a product and thus live in denial if and when the appeal of a business succumbs to new trends or competing products. I’ll not hesitate to take some of our profits off the table if indicators for these companies suggest its time to reduce exposure.

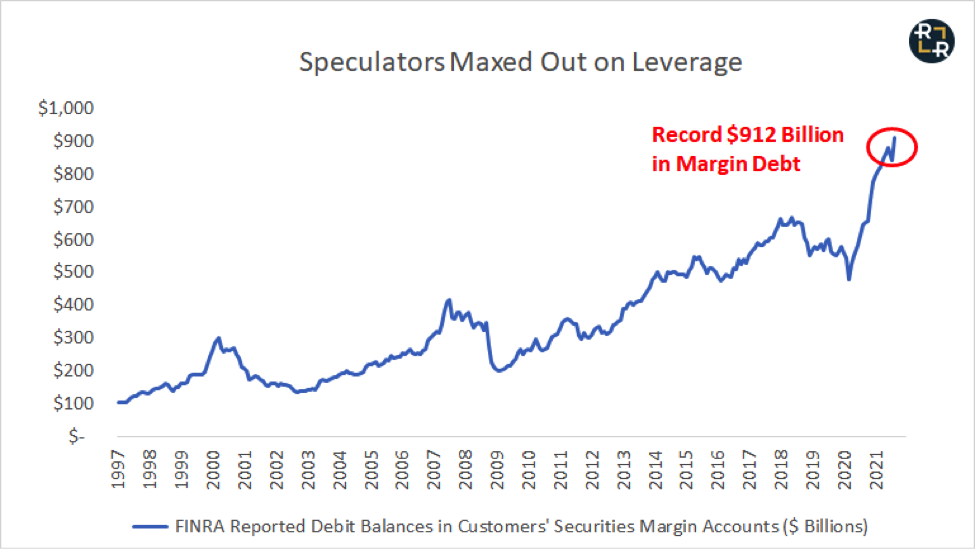

Another series of metrics seem also to warn of too much speculative fever, and the following chart is indicative of why I lean toward being somewhat risk averse at the moment:

Margin debt is taken on when an investor becomes a speculator. Margin use expands in part because investors are so convinced of the invincibility of their own judgment that they’re willing to borrow money, often paying a high interest rate, to buy more stock than they can otherwise afford. Some portions of the current financial markets are being driven by speculators, likely younger investors, who, flush with success in companies like Apple or Tesla, chatting to one another on Reddit, are investing out of FOMO[1] rather than from a sense of understanding and conviction.

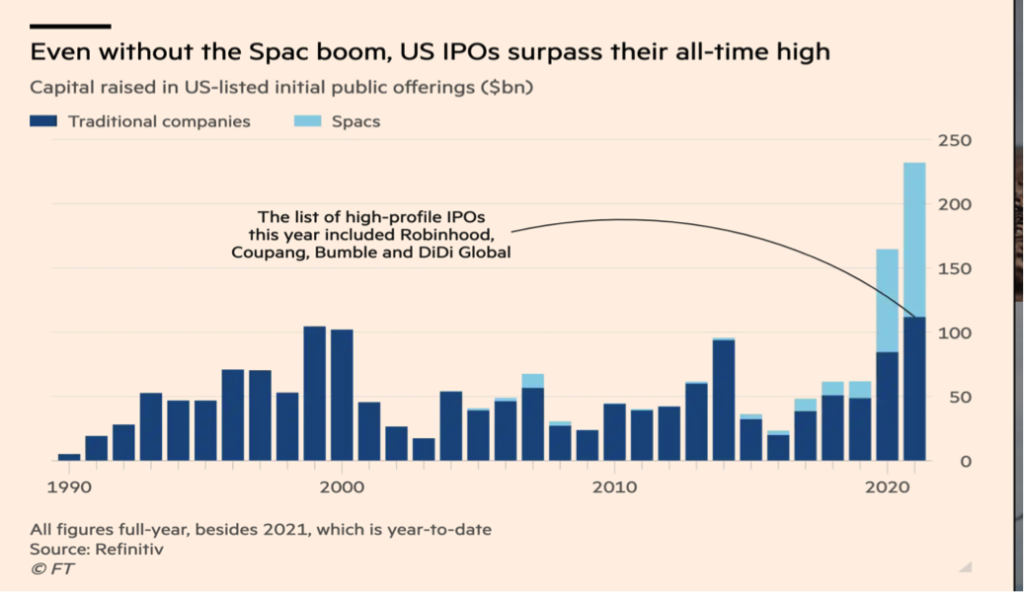

Other signs of froth have been telegraphed from the institutional markets. The past two years have seen record volumes of new securities issued, debt and equity, both here and abroad. This graph shows capital raises in the United States over the past thirty years:

Source: FT.com

The dark blue bars above refer to traditional initial public offerings (IPO’s) of corporations going public for the first time. When adjusted for inflation, which this chart does not do, the large volume of traditional new issues is not at record levels. By contrast, the light blue portion of the bar charts representing so-called “SPAC’s”, a development that calls for caution.

Wall Street is making a lot of money by pushing SPAC’s ,“Special Purpose Acquisition Companies”. This is one of the most venal money grabs I’ve witnessed in my long career. With too much money sloshing around the financial system, and near record low interest rates, investment bankers found they could convince people to buy new companies that have no operations! These entities purport to raise money for the purpose of acquiring other companies. They are often controlled by respected names on Wall Street like Bill Ackman or claim involvement of celebrities. These are “story stocks” on steroids. Basketball Hall of Famer Shaquille O’Neal, Golden State Warriors player Stephen Curry, tennis champion Serena Williams, and former pro baseball player Alex Rodriguez are some of the notable professional athletes who have been involved in SPACs in some capacity. What could go wrong?

Investing in a SPAC is buying a “pig in the poke”, but apparently this does not faze certain investors. To me, the ability of promoters to sell a story with little substance to so many investors, is a clear indicator of froth in the markets.

Cautious investors have taken note of speculative indicators such as those discussed above. Markets reached record highs, then stalled in this recent quarter. So far, we have had rolling corrections, not the “everyone-head- to-the-exits” collapse for which Wall Street is infamous. Modest sell-offs, 5% to 10%, rolling from one industry group to another is a desirable way for things to adjust to more attractive buying levels. It would be lovely to see this backing and filling continue for another four to six months, in my opinion.

So far, a number of our mostly profitable holdings have given back single digit percentages of their value, and still remain trending above their 200 day moving average, a key technical indicator. This indicator bears watching. At the beginning of the quarter, a rare 90% of the Standard & Poor’s 500 stocks were trading above their 200 day price moving average. This percentage deteriorated throughout the quarter and although it remains at a healthy 68%, the trend is of some concern.

I‘ve commented in my blog at (www.trustedfinancial.com) in the June 30 mid-year commentary, that the “transitory” inflation Fed Chair Powell has been talking about, may not be at all transitory. I’m one of the many who worry that government efforts to gift non-working people with free money, government deficit spending, supply shortages and artificially low interest rates may embed inflation expectations and lead to multi-year price increases. High inflation threatens people on a fixed income, like retirees, by eroding the buying power of the money in their pockets and the buying power of their pensions. To pay for its largesse, government engages in repeated raids on the wealth of successful people with tax increases both direct and through back door means. Successful people pay a lot more for Medicare than ever anticipated over the many decades of paying into the system. Social Security was untaxed by the Federal government for the first fifty years of its existence. Now, middle class recipients give back a significant portion of their Social Security income in taxes. Progressives are calling for a tax on the growth of assets, even if holdings have not been sold or traded to generate actual cash returns. This is chillingly similar to the approach taken by Communists in Russia a century ago. Protecting wealth today is a full time job!

The road to inflation protection is to own businesses that are likely to increase dividends year after year. Pricing power is becoming, for me, a heavily weighted criteria in stock selection. My radar is, therefore, attuned to finding companies that have monopoly or near monopoly status and pricing power. If a company is able to raise prices on consumers without much backlash, then they can use the increased income to increase their dividend payout to shareholders, a great way to offset the rising cost for groceries. For example, if Netflix increases its Standard monthly subscription fee from $13.99 to $ 14.99, are you likely to cancel the service? Let’s say ten per cent of Netflix subscribers do cancel and subscriptions fall from 210,000,000 to 190,000,000 worldwide. Even with this hypothetical loss of customers, the company will have increased its revenue by $190,000,000 per month, or about $2,000,000,000 per year. This relatively small price increase would pump up Netflix’s annual sales by 10% with nearly half that falling to the bottom line. Similarly, were Amazon to again increase the cost for Prime or Costco the basic cost of membership, will you refuse to do business with them? Owning companies with pricing power is an especially attractive approach in an era of elevated inflation.

Crypto or Gold?

From some quarters alternative investments are touted as the investment alternative to stocks and bonds. I’m sure you’ve heard about Bitcoin or one of the other crypto “currencies”, if not directly, then from someone under age 40. To date, I’ve not been able to reach a comfort zone with this asset class (if it is one). Crypto currencies, NFT’s and other block chain derived assets can be illiquid (not easily converted into cash), difficult to report, subject to theft and extremely volatile. Still, as inflation worries grow, the traditional hedge of choice, gold, has shown little inflation protection. Additionally, gold, often touted by its aficionados as “panic insurance” failed at this task when the Covid 19 panic broke out in early 2020, and the chart below proves this.

Going back three years, gold has not been a bad investment, but given its questionable reputation as an inflation hedge and the fact that no dividend income can be earned when holding this metal, we are currently avoiding gold.

Source:Stockcharts.com

By contrast, the best known of the crypto “currencies” Bitcoin, has seen a spectacular surge over the past three years, and especially during the past 12 months. My guess is that a certain amount of money has turned from gold as the favored inflation hedge and instead embraced Crypto. Despite its many enemies, especially regulators from Beijing to Washington, Crypto currencies appear to have gained recognition as a legitimate asset class. Goldman Sachs is now offering their investors the ability to buy crypto currencies. Schwab Institutional, I am told, is looking into adding and showing crypto holdings in client accounts. As a conservator of client assets, I cannot get comfortable with this investment yet, but remain open minded and building knowledge that may one day allow for a small diversification into this asset class.

What’s Ahead?

The resiliency of the world economy, especially for nations that have modern communications infrastructure, has been impressive. While Big Government believers credit massive government spending and efforts to manipulate the cost of borrowing lower, I feel there has been too little recognition of the ingenuity and hard work of ordinary people, from medical professionals to information technology specialists, teachers and restauranteurs. Businesses have often learned to be flexible, and we have undergone a permanent change in assumptions about where and how work can be effectively performed. This promises an ongoing productivity revolution that, I believe will sustain our economy in an upward direction for some years to come.

While there has been some deterioration in share prices in this quarter, as yet there does not appear to be evidence of a coming crash in stock prices. Still, with a number of indicators flashing warning signs, be assured of my vigilance and attention to your financial well-being.

Reminder: Trusted Financial’ s annual Holiday Luncheon is scheduled for December 9 at 11 AM at Capital Grille at South Coast Plaza. Please mark you calendar and plan to join us!

Disclaimer

Investment advice is rendered under written agreement only. You are cautioned not to act or invest on the basis of opinions rendered herein. Trusted Financial Advisors will not be held responsible or liable for any actions taken by those who are not currently clients of the firm.

[1] “Fear of Missing Out” FOMO