Quarter end Report March 31, 2021

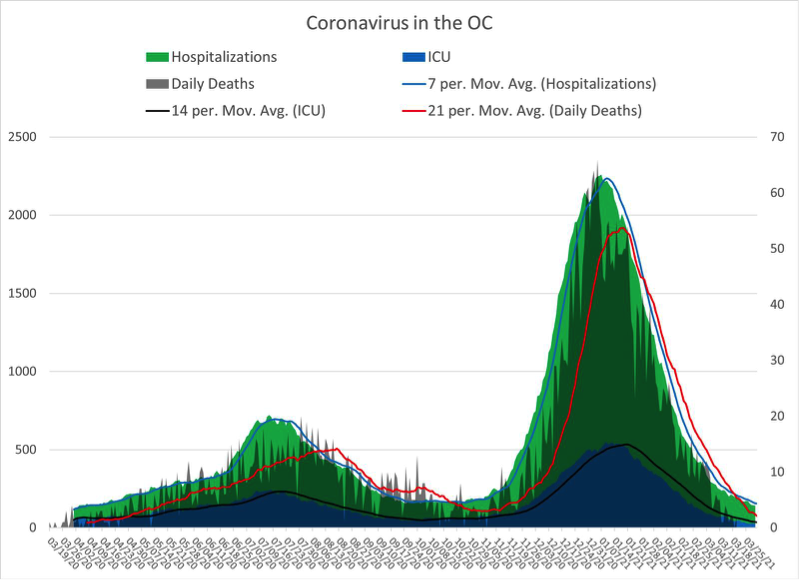

The first quarter of 2021 saw a decided turn from a “pandemic mentality” to re-opening euphoria. Elders in most states were told they were first in line for one of the two approved Covid-19 vaccines but found frustration in trying to get access. Thankfully, by mid-February, it became clear that cases and deaths from the disease were on the decline here in Orange County, but also in most parts of the USA.

Source: www.nextdoormarinahills.com

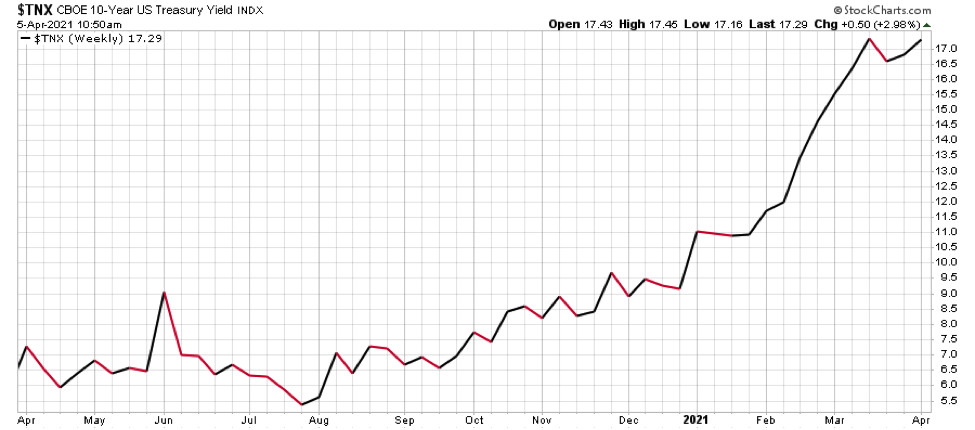

This quarter-end closely marked the anniversary of the Covid Panic Bottom, so returns for stocks appear stupendous, with the S&P 500 up 56% and the International stock Index (MSCI ACWI) up 54% over the past 12 months. Even alternative asset classes enjoyed a rapid twelve month recovery. The Dow Jones U.S. Real Estate index rose 35%, while the Bloomberg Commodity Index was up 35%. A sharp increase in prices for building materials, in particular, put inflation worries front of mind for some economists. A debate is raging between advocates of Modern Economic Theory like Robert Reich, Labor Secretary under President Obama and Lawrence Summers, Treasury Secretary in the Clinton Administration. Summers has vocally opposed the amount of debt created by the most recent Covid spending plan, which adds about $1.9TT to the national debt[1]. He is not alone. When investors begin worrying about high inflation, which is often the result of excessive public spending, they demand higher yields before buying Treasury bonds. Economist Ed Yardeni calls them “Bond Vigilantes”. This posse went to work during the recent quarter, and ten year T-bond yields rose sharply:

Source: Stockcharts.com

When interest rates rise sharply, investment grade bonds lose value. So, cautious bond investors felt a bit of pain; the Barclays U.S. Treasury bond index was off over the past twelve months by 4.25%, while the Barclays U.S Corporate Bond index fell 4.65%

Yet, high yield (AKA “Junk”) bonds squeaked out a gain of .85%. This is likely due to two factors. First, corporate debt has been refinanced at exceptionally low interest rates over the past few years, which helps the debt paying ability of even lower credit borrowers. Second, institutional investors are hungry for yield, and found it in the debt issues of energy companies, financial companies, airlines, hotels and restaurant chains, financially fragile industries.

Portfolio managers historically rely on bonds to dampen portfolio volatility, so bonds are embedded in nearly all balanced accounts. For the past 40 years however, U.S. interest rates have been in a secular downtrend. When interest rates fall, the stock of older, higher yielding bonds becomes more valuable. As a result, balanced portfolios have enjoyed not just stability from fixed income investments, but a boost in value. This tail wind is clearly at an end, in my opinion. Portfolio managers and financial advisors are in a quandary as to how to reduce volatility without relying as heavily on bonds as in the past.

Rather than loading up on bonds or bond funds at current low interest rates, we’ve found a haven in preferred stocks.[2]

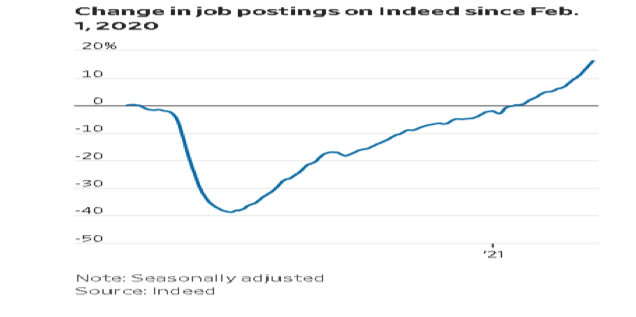

An incessant call for more government programs to support an allegedly ailing economy are starting to sound specious to those who are following the economic pulse. Not only did employment figures surge with the February jobs report, published April 3, but a private survey of job postings suggests we may soon return to the labor shortage that had become a problem just before the pandemic shutdown began:

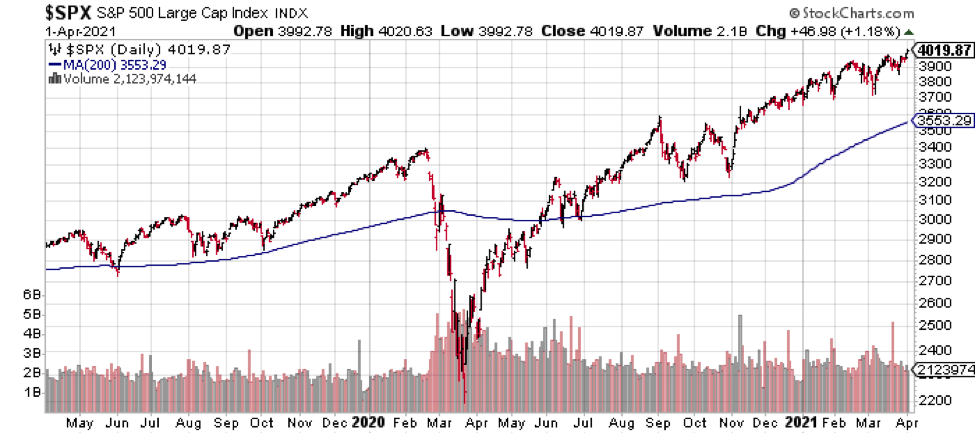

Equities Recover….and More

Recovery in stock values since the March 2020 low has been beyond all expectation. This two year chart of the Standard & Poor’s 500 index tells quite a tale:

An upward trend that was in place for eleven years, (a record long bull market) was decisively ended when the Covid 19 pandemic struck. With record government intervention, confidence was quickly restored. This resulted in the shortest bear market in living memory. Now, the prior upward trajectory is back in place with over 80% of stocks trading well above the important 200 day moving average (in blue). As of April 1, 2021, the Standard & Poor’s 500 achieved a record new high of 4000. Was there even one economist who thought that would or could happen?

The reasons for this remarkable recovery are many. Technology helped provide an alternate channel for overcoming potential business disruption for many industries and services, when face-to-face meetings were discouraged. Advances in genetics resulted in the most rapid creation of vaccines in history. Then there was the backstop provided by government. First, the Federal Reserve stopped an incipient liquidity panic a year ago by promising to, in effect, buy nearly any security that was experiencing distress. This was a replay of the coordinated rescue of 2008, but on steroids. Shortly thereafter, in a rare show of unity, Republicans and Democrats enacted a spending and recovery plan to help small business and the unemployed with special stipends, tax deferral, rent deferral and other tools to soften the blow. Just recently, Democrats used their slim majority in Congress to push through another, massive $1.9TT relief package. It seems everyone in America is getting a check (except this author!)

With vast amounts of government spending coursing through the economy, some believe that a 1920’s style boom is or will soon be underway. The implications for investors in nearly every asset class are promising, for now.

To be sure, endless government deficit spending is a big worry for those of us who have studied economics and/or who lived through the “runaway inflation” of the 1970’s. When any entity, including the United States, proves unable to service or to repay its debt, confidence wanes and the borrowing comes to a painful halt. Historically this results in a serious financial slowdown. Since the days of the Great Depression, deficit financing has been the rule for the Federal government. The Big Spenders have managed to borrow for some 90 years without immediately destroying the value of the dollar[3]. Their secret is managed inflation.

Inflation is a friend to the irresponsible government borrower, as the government can repay back loans with money that has become worth less in terms of buying power. At a 3% inflation rate the dollar loses some 60% of its buying power over the life of a 30 year Treasury bond. [4] For retired couples on a fixed income, there is a need to be vigilant and to have savings and investments that grow more rapidly than the corrosive force of inflation on buying power.

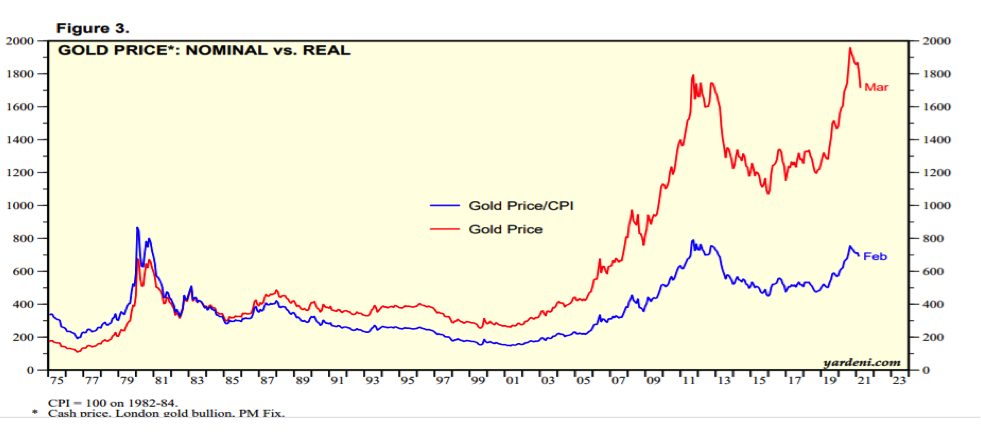

A popular hedge against inflation is supposed to be gold. As it turns out, despite a ballooning of deficit financed spending schemes, gold is off 9% year to date. Further, its longer term track record, suggests it has not been a reliable inflation hedge. In the chart below, courtesy www.yardeni.com, the blue line tracks the real buying power of gold, that is, the nominal price divided by consumer price inflation:

Gold’s apparent all-time high price, recorded last August, was in fact only a return to the artificially inflated value during the precious metals fury of the late 1970’s. Owning gold over the past decade has retained buying power, but for most of that time, those storing gold in a safe deposit box or in the back yard were in a losing position, while stocks rocketed higher.

Source: Stockcharts.com

This runs counter to virtually all “gold bug” assurances foisted on investors for decades. I’m not saying gold or other precious metals have no place in an investment portfolio. In fact, we scored a nice profit in gold in 2020 for some accounts. Still, it is a reminder that wide diversification opens opportunities that narrowly focused investors may miss.

Gold, silver and precious stones are considered “real” assets. But the most popular and most easily financed real asset, single family homes, have seen their prices soar of late. For years, I’ve predicted that the Millennial generation would transition from single renters to married or cohabiting family home buyers, but my outlook was too early by about four years. This transition is finally in process, accelerated by historically low mortgage borrowing rates and the Covid-driven fear of Big City apartment living.

A decline in the buying power of the dollar is a given. The question debated by policy makers is whether a coming spike for inflation will prove to be a temporary blip or becomes embedded as a damaging influence on the buying power of every day Americans. I expect the latter. Going forward, portfolio selection will need to seriously consider which asset class will best protect against inflation.

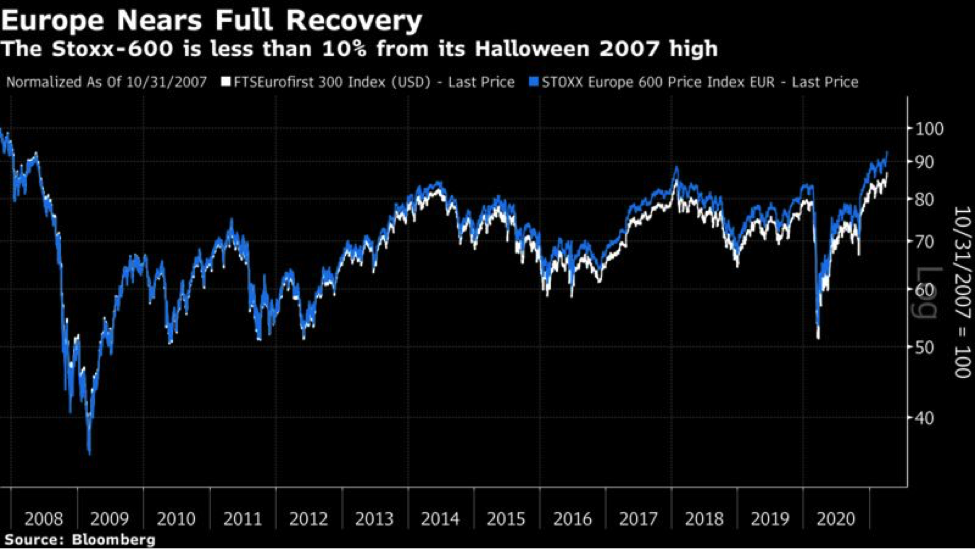

It appears the world economy is getting back on track, and this chart of European bourses shows the highest level since the “Great Recession” over 12 years ago! Our portfolio advice has been to add foreign exposure in the past quarter, as price earnings ratios abroad are generally fraction of those to be had from U.S. companies.

Although this report has focused largely on broader economic forces, we tend to be “bottom up” value investors at heart. While keeping an eye on the Macro-economic environment will be important, I’m always seeking unusual opportunities for outstanding profit. Therefore, you are invited to review a recent posting: “Our preferred way of Investing” under the “Financial Literacy” section (top tabs, far right).

Our client-centric approach to balancing risks with client goals for growth, income and comfort will continue to evolve, but we strive to keep Warren Buffet’s “Rule Number One” front of mind: “Don’t lose money”![5]

[1] https://www.bloomberg.com/news/articles/2021-03-26/summers-warns-u-s-risks-rising-inflation-amid-massive-stimulus?sref=jj777dAZ

[2] See our website under “Financial Literacy” for an article: Our Preferred Way of Investing”.

[3] To be sure, the buying power of the U.S. dollar has dwindled over those past 90 years to the point where a dollar today will not buy what a dime did back then.

[4] Best of all the elected officials who countenanced this profligacy have all retired and/or died by the time the bill comes due!

[5] Warren’s Rule number 2 is “Remember Rule Number One!”