“Biology will drive the economy”. – Michelle Seitz, Russell Investments appearing on Bloomberg’s “Wall Street Week”

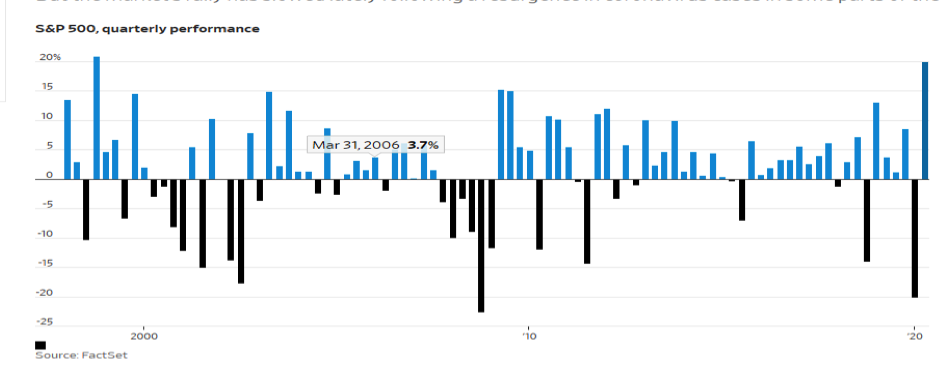

Equity markets continued a remarkable recovery that began in the last week of March right through this June quarter. The Standard & Poors 500 is now just 8% off last year’s December 31 close. Despite a reduced equity exposure, those stocks we kept for active clients were oriented to the same technology names that have led the recovery. Further, a healthy recovery in debt oriented positions has brought many clients back to where there are minimal declines for the year.

At the end of the last quarter, three very long months ago, the best and brightest minds were nearly as one suggesting the world economy was headed into a major recession if not a Depression. Then a massive bout of deficit spending coupled with unprecedented actions by our nation’s central bank to backstop corporate debt drove a massive rally (about 39% from the March 23 low) that allowed major indexes to recover most of the losses seen since the market peak in late February.

Source: WSJ.com July 1, 2020

The pessimists, whose doleful analysis seemed eminently justified, have been so far proven wrong. A relatively healthy balance sheet for consumers, enterprises and banks appears to have allowed a broad swath of publicly traded companies to so far weather the storm and quite a few have bolstered their liquidity by borrowing money mostly through bond and preferred stock issuance at historically low rates. It has taken an extraordinary dose of government intervention to help small businesses and to sustain workers who may be living paycheck to paycheck. A supplemental unemployment stipend from the Federal government is scheduled to run out in July raising fears that many workers and their families may go over a financial “cliff” that could further erode consumer confidence and thus spending. To top it off, July marks a renewal or expansion of social distancing measures as Covid-19 infection rates have again headed north in much of the country.

Leading an equity recovery were the same internet and social media heavyweights that have led the market these past five years. Because the broad indices like the Dow Industrials and S&P 500 are capitalization weighted and thus heavily weighted toward Mega-Tech companies, index funds rebounded nicely despite the fact that they also hold many companies in the travel and leisure, consumer discretionary and energy sectors, which saw but a tepid recovery. By contrast, the NASDAQ composite, heavy in technology and biotech companies, reflects the influx of money to these two popular sectors:

Certain of our client holdings, Amazon, Microsoft, Apple, Google, American Tower and Equinix are enjoying the sweet spot of being companies that benefit from a massive increase in online communication. With exception of Google those mentioned not only recovered but went on to mark new historic price highs.

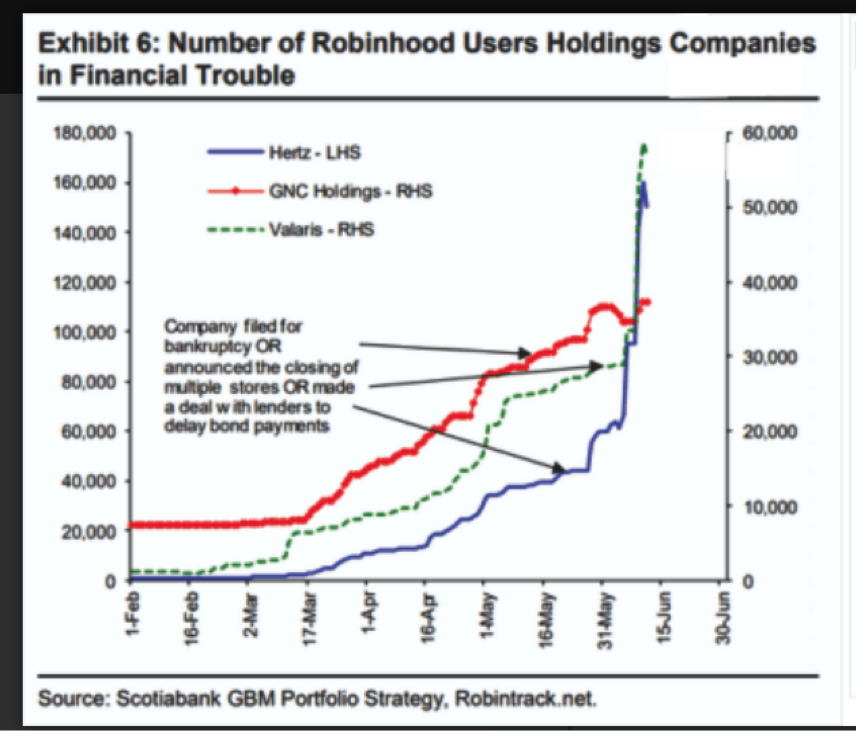

It has been suggested that investor focus on familiar technology names has been driven by generational factors: Millennials, many of whom are in their mid-to-late ‘30’s are a rising financial force. Since this generation pretty much grew up with computers and smart phones it is not surprising that they find tech companies appealing. Still, some market observers believe speculative behavior is responsible, in part, for a new Tech Bubble. Too young to recall the pain of the Tech Wreck of a generation ago, Millennials with too little experience are piling into internet related companies simply because the name is familiar or some young guru posting on Reddit is touting the stock. Curiously however, a version of “value” investing appears to have won respect among the Millennials. As the shares of some troubled companies plunge, new money has flowed in, under the assumption that the Fallen Angel is now a bargain. Below is a graph evidencing an unusual phenomenon – companies that, after filing bankruptcy reorganization, have seen demand for their stock!

Is this behavior evidence that we are near a market top, and that the recent market recovery has been only temporary? Only time will tell. As many of our clients can attest, every generation, while young, makes financial mistakes that amount to an expensive education. That is why, after accumulating substantial assets later in life, they may seek professional management. While we continue to like technology and “cloud” computing names, the recent rapid recovery gives us pause.

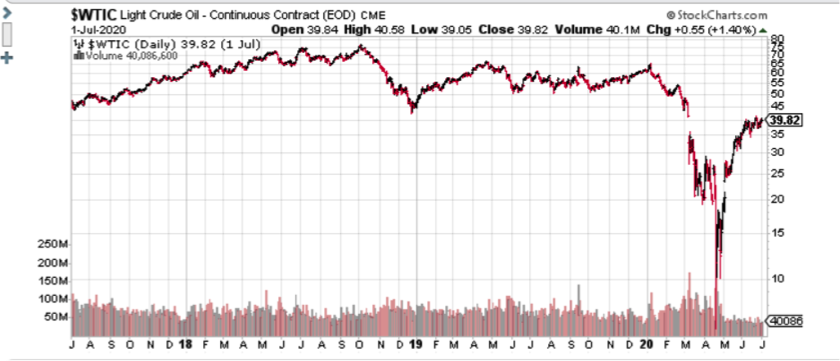

Commodity prices seem to be telegraphing a rebound

As the Corona Virus driven bear market evolved, oil and gas prices suffered the most falling from about $60 per barrel to under $10. As if a worldwide contraction were not bad enough, Russia and Saudi Arabia chose the moment to enter into a price war, believing they could put American producers out of business.

But an historic collapse in oil prices imposed at least as much pain on the enslaved people of these two dictatorships, and there is nothing a strongman fears more than an unhappy populace. A rapprochement was made, the taps turned down and along with recovery hopes, oil has somewhat regained its price. However, these two major energy producers appear to have been successful in damaging American producers. Energy is a major American industry. We once cheered weak oil prices in most of the country, but now that America is the world’s largest producer of oil and gas the current softness in price is another reason to worry about our economy. Producers are slowing production and development in the face of low prices. There is a definite recession in the American “Oil Patch”, yet the recent rebound in prices does not appear sufficient to prevent what appears to be the inevitable collapse of many highly leveraged producers. During the last week in June, fracking pioneer Chesapeake Energy, one of the largest, filed for Chapter 11 protection and more such filings are predicted. Recall, it was the fracking boom that largely lifted our economy out of the doldrums after the Great Recession of 2008-2010. Likewise, the energy price collapse exacerbated last quarter’s market correction. I have generally steered clear of this volatile arena, with the exception of some pipeline holdings that pay good dividends. However, even these defensive investments have languished in the current environment.

A hopeful message from “Dr. Copper”

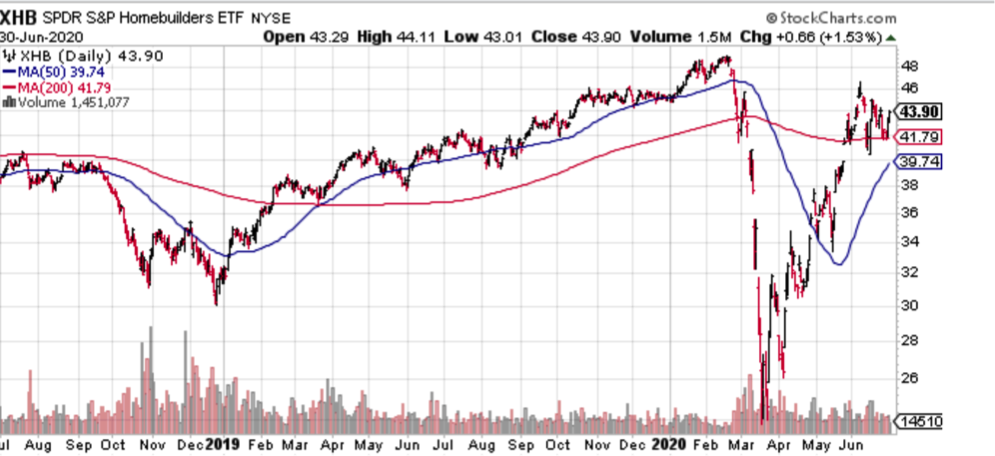

Confounding the pessimists, the price of copper has recovered virtually all its pre-Covid losses, and this appears justified by resilience in housing.

It is interesting to note that a popular exchange traded fund built on the shares of home builders has seen a parallel recovery to copper:

Housing is a promising sector. Millennials, the largest demographic cohort, have been forming families for the past ten years, while full employment (until recently) suggests many have been able to save for a down payment on a home. There appears to be a shortage of affordable units to meet this demand, so builder stocks have seen one of the healthier recoveries. A secular growth story for housing may well be under way.

Gold still shining

Strength in gold may not be offering the positive message broadcast by copper. Gold is approaching its historic high last seen in 2011. No one seems to be sure what is driving this rebound. However, traditional gold bugs, who tend to be monetarists, believe that massive money creation will lead to a fall in dollar’s buying power and a higher rate of inflation. Since neither political party seems to care how out of control our nation’s deficit is running, these concerns appear justified. Although gold plays a minor part in many client portfolios, this year it is certainly providing a bit of ballast against the rocking and rolling of common stocks.

Fixed Income Investments Rebound

A major component of client portfolios, bonds generally had a strong quarter, but only after the Fed stepped in and promised to buy bonds so as to allow corporations to continue to access the capital markets. With that recovery, Pimco’s Investment Grade Corporate Bond index ETF actually achieved new all time high prices:

As with stocks, the selloff in bonds was so brief as to allow little opportunity to buy at bargain prices. I did a bit of portfolio rationalization, but mostly held on to holdings of companies I consider to be bullet proof. So far this has proven to be the right approach.

Economists who I respect like Ed Yardeni and Ray Dalio opine that we are in a new era, one in which government imposition of artificial liquidity and interest rate controls are the main forces supporting the economy. At some point they believe there will be resistance from investors to buying the firehose flood of government bond issuance that allows the Treasury/Fed Axis to delay a recession/depression. Dalio suggests we will see a weakening of the U.S. dollar followed by a surge of inflation and then a flight of capital into inflation hedges like stronger currencies, shares of companies that can prosper in an inflationary environment and into gold, commodities and real estate. I must say, however, that this has been a standard prediction of monetarists since the 1970’s. Their timing has proven to be erratic at best.

What’s the Outlook?

Attempting to call the future feels a bit like walking barefoot into a darkened room after a bad earthquake. What shards of glass lie waiting for the next step? There is the nagging question: “what are we forgetting?” Somehow, each financial crisis comes out of left field. Somehow, we come to realize that there were questions we forgot to ask during the good times. While I try to answer these questions, it is difficult to measure and predict human behavior, which is of paramount importance in driving the course of a pandemic that unless brought under control threatens a prolonged and deep financial downturn.

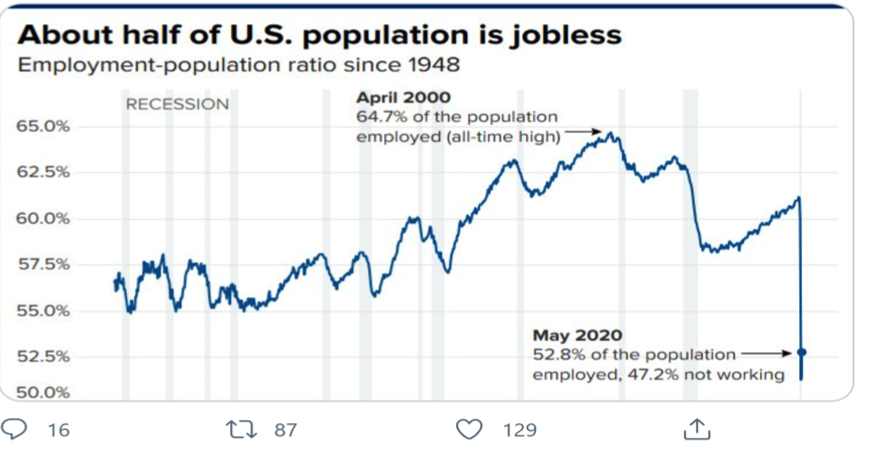

Humanity is in a dilemma, trying to protect against a murderous virus, but fearing the economic distress social distancing and business closures will bring. This chart is a reminder of how exposed the U.S. economy is to the possibility of massive financial stress and a loss of consumer confidence:

The unknowns are even more unknown than usual. This suggests a continuation of caution in portfolio construction going forward.

Presaging a predicted wave of corporate failures, these past months have witnessed bankruptcy filings from Hertz, Neiman Marcus, Chesapeake Energy, J.Crew, Forever 21, JC Penney and Pier 1. Centric Brands is also undergoing bankruptcy and reorganization. Theirs may not be a familiar name but the brands it licenses are: Tommy Hilfiger, Under Armour, and Michael Kors to name a few. Others, particularly in leisure and energy sectors will no doubt follow. Of concern is how bankruptcies may affect lenders. Although recent bank stress tests appear to provide some reassurance, the Federal Reserve forbade banks from buying in shares or increasing dividends, and some may be forced to reduce dividends so to improve bank balance sheets during this time of uncertainty. So far regulations that forced banks to increase their “Tier One” capital after the Great Recession have avoided the need for a banking bailout.

Has the Election already been discounted?

Markets tend to predict the future about six months in advance. If the current polls are correct, Joseph Biden will replace Donald Trump in the White house in January, but Democrats may not control both houses of Congress. This will prevent a sweeping increase in income taxes and a wave of environmental and social safety net expansion. Wall Street tends to prefer lower taxes and less regulation. Still, even if Democrats do take full control of the government, a recent article at the www.marketwatch.com web site suggests that a Democratic sweep in November is not the disaster capitalists might fear:

“Should Biden win and the Democrats sweep the House and Senate, historical data point to investor gains. Nicholas Colas, co-founder of DataTrek Research, says U.S. equity markets do better when one party controls both the White House and Congress, with the S&P 500 index since 1945 rising by an average of 16% under all-Republican governments and 14.3% under all-Democratic governments. That compares with an average return of 10.8% between 1945 and 2019, helping explain why equity markets have been resilient as the odds of a blue wave have risen in recent weeks.”

At any rate, with markets showing resilience it does not appear that the upcoming election is weighing heavily in the mix. Predicting elections and their aftermath is above our pay grade so this is likely a good time to hop off and say thanks for reading and goodbye for now!