Coco Nuts!

Most clients of Trusted Financial will open their monthly statement and find a bit of relief as a stock market rally ignored a potential meltdown for banks. Still, there seemed to be plenty of investors trying to call a bottom to the bear market. Some Media pundits are now declaring that a new bull market is at hand. I beg to differ.

Although the sudden collapse of Silicon Valley Bank generated more of a panic and more alarming headlines, I feel a disappearance of a major Swiss bank has equally worrisome implications for financial markets. In order to meet stringent capital requirements agreed by the Bank of International Settlements after the Great Financial Crisis fifteen years ago, Banks were allowed to raise capital not only by issuing more stock but also by selling a unique instrument called a Contingent Convertible Bond, “CoCo” for short. In compelling the takeover of Credit Suisse by Union Bank of Switzerland, Swiss banking authorities invoked a clause in the Credit Suisse Contingent Convertibles’ trust indenture stating that rather than attributing the bank’s losses to stock holders, it would be the CoCo bond holders whose value would be marked down…completely. This peculiar sort of bond has been issued to investors by banks around the globe. It seems some of those who invested in CoCo’s did not appreciate the amount of risk they were taking. Some critics have labelled CoCos as “a bond with a hand grenade attached”. If you are confused and do not need the wonky details skip to the “bottom line” in bold below. If you are a glutton for punishment, read on 😊:

The Great Financial Crisis of 2007-2009 taught bankers and regulators that it is vitally important for a bank to have readily available cash to meet any ”run” on the bank that might occur. Banks’ assets often consist of real estate owned, stock in corporations, mortgages or trust deeds, corporate bonds and notes and Treasury notes and bonds. The latter is the most liquid holding, and thus considered Tier 1 capital, assets that can be easily sold for ready cash. During the Great Financial Crisis, over-investment in low quality mortgages meant that banks of all sizes, notably money center banks like Wells Fargo, Citibank, Washington Mutual and Bank of America were in imminent danger of being unable raise cash to pay depositors who had become frightened and began massive withdrawals.

In the aftermath of the Great Financial Crisis the world’s major central banks sought to drastically improve the composition of bank balance sheets by requiring that their assets include a larger amount of so called Tier 1 capital. Each nation enforces the rule with some variance but the idea is that banks must hold a greater ratio of cash and highly liquid investments. Typically, banks can raise cash by offering common or preferred stock for cash, or by holding safe and easily sold government bonds, such as T-bonds and T-bills. However, T-bills, until recently, paid low interest rates and banks would prefer to free up cash to lend to borrowers at higher yields. Inventive banks also began raising capital from outside investors, not by issuing more common stock, as this dilutes and weakens the value of common stock for existing owners. Instead a newly designed instrument, the “Contingent Convertible bond” (AKA “CoCo”) was born. These bonds pay higher interest rates than traditional bonds in return for acceptance of language that essentially says: “if the bank is taken over by authorities, is liquidated or is forced to merge”, the CoCo bond obligation will be suspended and the bonds will be considered to have no redeeming rights or value. Although terms differ from nation to nation and issuer to issuer, CoCo bonds can be considered as junkier than junk bonds! CoCo’s should really be the province of sophisticated institutional investors. In the case of Credit Suisse, when the Swiss authorities voided the value of the bank’s CoCo’s, their owners cried foul, claiming they should be made whole. Not too many tears have been shed by the general public or regulators.

Bottom line, if a banking crisis spreads it could mean that banks will no longer be able to improve their capital requirements by issuing CoCo’s, meaning they may have to issue more common or preferred stock, or dump their T-bill and T-bond holdings, often at a loss, into a nervous market.

I spoke with a recently retired auditor who worked for the Federal Deposit Insurance Corporation (FDIC). He was critical of the negligence of Federal Reserve auditors, who should have seen a red flag in the rapid growth of Silicon Valley Bank(SVB) in the past three years, Apparently the bank’s loan book was too concentrated in tech start-up technology companies. These companies had parked working capital at the bank, money that could be withdrawn instantly. Meanwhile, SVB’s investment department invested much of this money in intermediate to long term Treasury bonds, a seemingly safe bet. However these long dated bonds cratered in value in 2022 when the Federal Reserve Board rapidly raised interest rates and began dumping longer dated securities into the market to right size its own mix of assets. My auditor friend opined that Silicon Valley Bank had plenty of time to reduce its ownership of long term bonds, because Fed Chairman Powell warned for months that the Fed would be tightening credit conditions before they actually did, about a year ago.

SVB avoided the extensive auditing and “Stress tests” to which larger, money center banks are subject each year. In the aftermath of the GFC, the Fed mandated any bank with over $50 billion in assets was subject to these tests. But in 2018, Congress, in a bi-partisan vote, changed the rules so that banks with less than $250BB escaped stress testing. Voila’ it took just 4 years until three, lightly regulated mid-sized banks required help to prevent failure. To the surprise of this observer, regulators rushed to protect these banks’ depositors and assured them that they did not need to worry about current FDIC insurance limits of $250,000. Why? Lack of vigorous regulation made all mid- tier banks suspect and vulnerable to a run on deposits. Had the situation gotten out of hand, a repeat of the 2008 bank rescue might have become necessary, and with it the need to ask a very reluctant Congress for money.

Banks face a host of challenges, including shrinking net interest margins as a result of holding low yielding loans at a time when they are being pressured to pay higher interest rates on deposits. The collapse of Silicon Valley Bank, and near- collapse of First Republic and Signature Bank and Credit Suisse, was an eye-opener for an already nervous market.

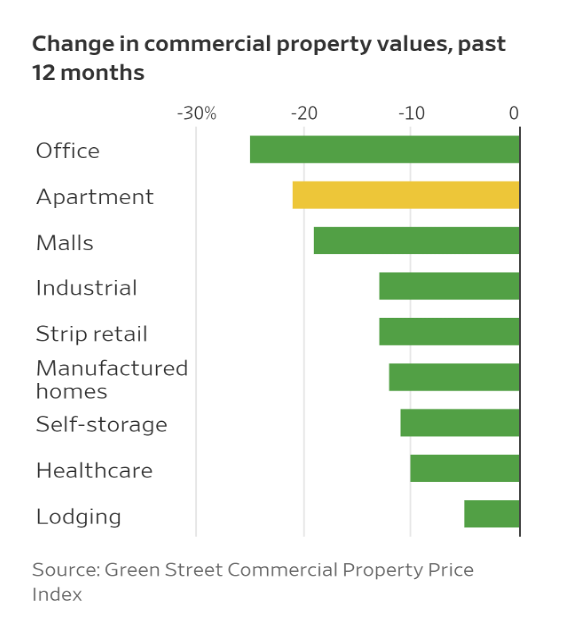

I suspect there is more bad news ahead for regulated commercial banks and for non-bank lenders. When interest rates go up, businesses and individuals who have borrowed money tend to default at an accelerating pace. Here in the US, rising vacancies in commercial real estate are giving banks and regulators indigestion. It’s not just that a recession may be coming, but the Covid era revolution in “work from home” suggests there is a lot of unneeded office space for rent and the trend to “shop from home” suggests there is a lot of unneeded commercial space. These appear to be Mega trends that could devastate the value of non-residential real estate for years to come. Most buildings are owned on leverage financed by banks or mortgage backed bonds widely held in portfolios around the globe. During the recent quarter, multiple institutional investors like Brookfield, Blackrock and PIMCO walked away from commercial properties they owned. Simon Properties skipped a mortgage payment on a Mission Viejo mall.[1]

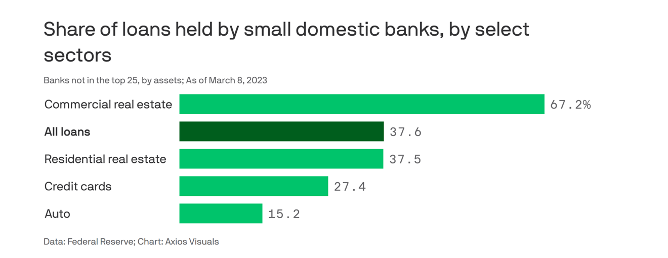

A high percentage of commercial real estate loans remain on banks’ books, unlike residential mortgages that are sold off as mortgage backed bonds. Further, the bulk of commercial real estate loans are carried by non-money center banks, banks not unlike SVB, First Republic and Zions, to mention another troubled institution.

Source: Axios online March 21, 2023

Source: Axios online March 21, 2023

Lending may hit the brakes, raising recession likelihood

Unsurprisingly, banks, especially smaller banks, are re-thinking their lending strategy. As loans come due, especially loans backed by commercial real estate, it is likely that many borrowers will have difficulty paying the higher interest rates now required, if they can get a loan at all. It seems naïve to believe there will be no further defaults and it seems equally naïve to believe no other banks or non -bank lenders will come out the other side of the current tightening cycle unscathed. With $936 billion in commercial real estate and multifamily debt due to mature in the next two years, what’s going to happen to the CRE market and those who’ve loaned money to property owners?

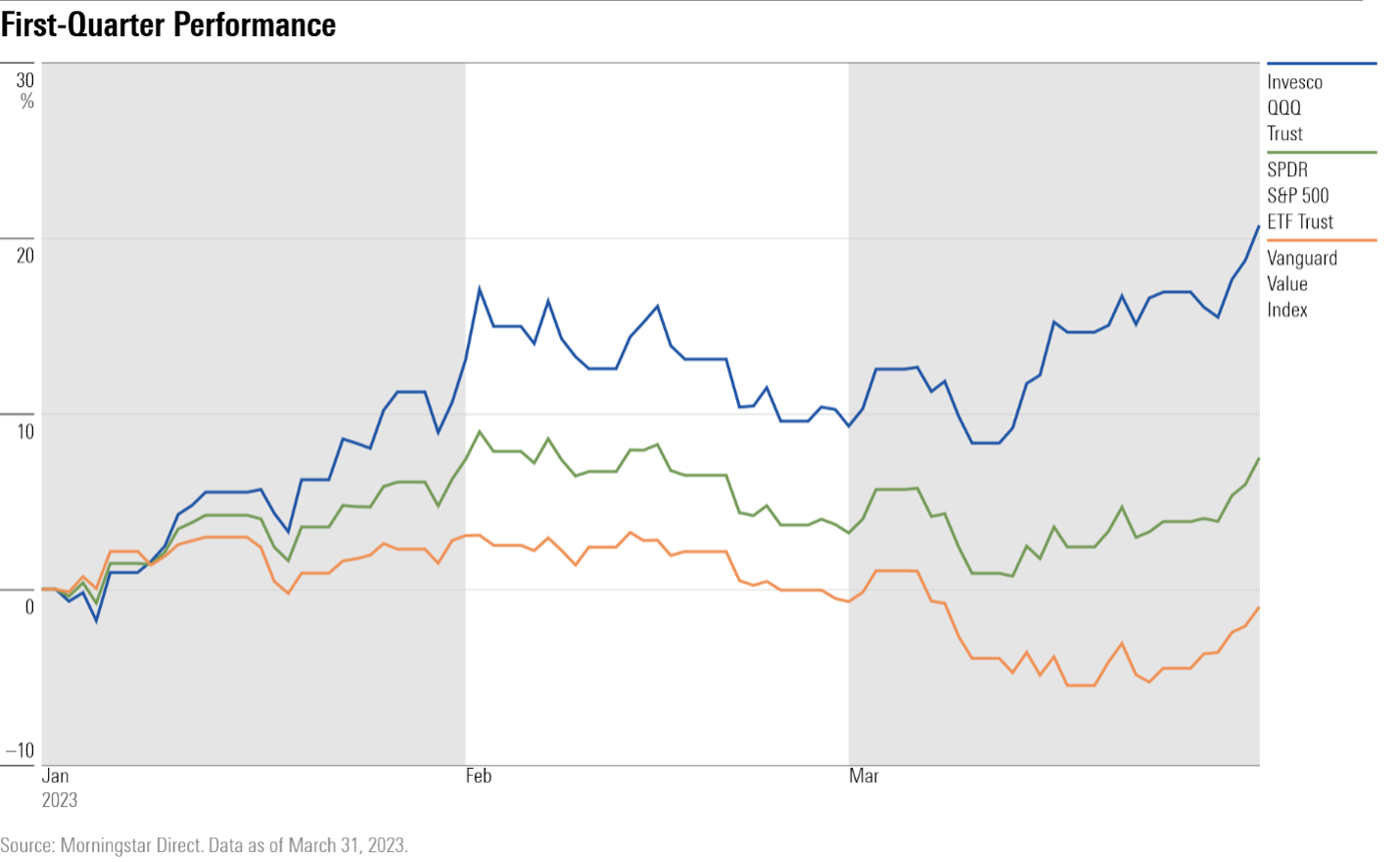

And yet, amid all this worrisome news, the stock market managed a rally, at least in the technology sector, the same sector that was brutalized in 2022. The Morningstar US Market Index finished the quarter up 6.9%, with mega-cap technology stocks fueling the gains. Tech stocks benefited as investors flooded into the beaten-up group, expecting it to benefit from the Fed pausing its interest rate rise and move to cut interest rates. Also, mega-cap techs are seen as having fortress like balance sheets able to withstand a serious downturn.

It is too early to believe that the market has seen a bottom or that we can begin optimistically sifting through lists of publicly traded companies for buying opportunities. As James St. Aubin, chief investment officer at Sierra Investment Management in Santa Monica, California, put it : “Credit is the oxygen of the economy, and we’re sucking out the oxygen at a rapid pace.” Corporate earnings predictions by management are trending down as well, suggesting that even if current price -to- earnings (PE) ratios can maintain, stock prices in general will continue to be under pressure.

As if banking worries were not enough, the political background is also fraught. Republicans, now in control of the House of Representatives, seem unwilling or unable to engage with the Biden administration on raising the Federal debt limit. This is couched as a noble effort to slow the crazy rise in government spending.It is a noble story and certainly many in the GOP are trying to bring more responsibility to government spending. But few protests were raised when at the onset of the Covid 19 pandemic, massive spending was authorized to counter the lockdown and signed into law by a Republican president. We’ve been here before, in 2011. As a result of the uncertainty generated by the political struggle over the debt ceiling, Treasury bonds lost their AAA credit rating. No one knows what might happen if a compromise is not reached by June, the absolute deadline for a debt ceiling agreement.[2] This unresolved situation, which comes to a head in less than three months, does not encourage ownership of risk assets at this time.

Signs of Moderating Inflation are unclear

Just before the quarter end, the Commerce Department reported that the Personal Consumption Expenditure index (PCE) rose .3%, which was below expectations and at a bit below an 5% annual rate of inflation. While certainly an improvement over last summer’s inflation run rate of about 8% it remains well above the manageable 2% annual inflation target of our Federal Reserve Board of Governors. Then with their usual bad timing, on April 1 OPEC threatened a significant cut back in oil production and this goosed energy prices higher. However, OPEC has proven to be undisciplined and the Russians will cheat, especially given Putin’s desperate need to keep his war machine running and his population from rebelling. John Authers, a capable writer/analyst for Financial Times sees the OPEC announcement as a sign they are perceiving softness in oil demand, a disinflationary trend. Companies like Amazon, Google and Facebook have been laying off workers, claiming a shift from growth at any price to more attention paid to profitability. Still, anecdotal evidence, at least here in Southern California, suggests businesses are still trying to fill jobs and are being forced to improve wages and benefits to do so. Restaurants remain busy and parking at the Mall is pretty crowded.

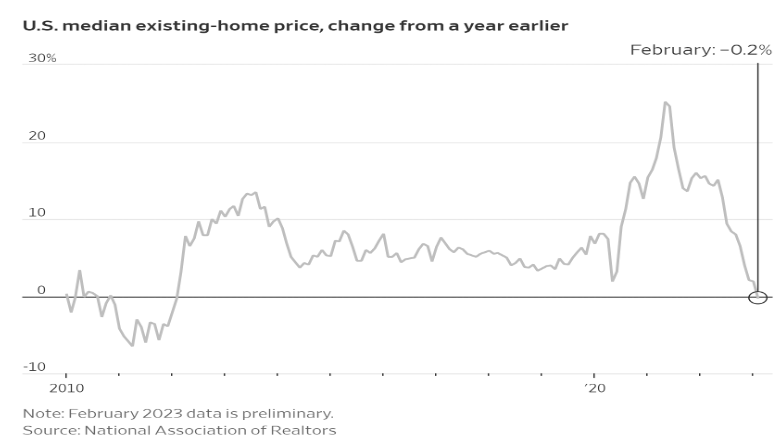

An historically unprecedented rise in the cost of money (interest rates) may be having the result desired by Western central banks: falling affordability of autos, trucks and homes. There seems to be some consumer resistance to rising prices but it’s just too soon to predict that we may see a significant decline for inflation in the coming months.

Are we in a bull market?

It was puzzling to see that stock indexes rallied in the recent quarter. The S&P 500 as up about 7% and NASDAQ as up 16.77%. While this rally failed to recoup the losses of 2022, some technicians believe we are bottoming and may already be in a new bull market.

Many clients continue to hold modest positions in leading technology companies Microsoft and Apple. They also hold utilities like oil and gas pipelines paying high cash flow yields. Preferred stocks with high yields have mostly held up and continue to drop payments into client accounts on a regular basis.

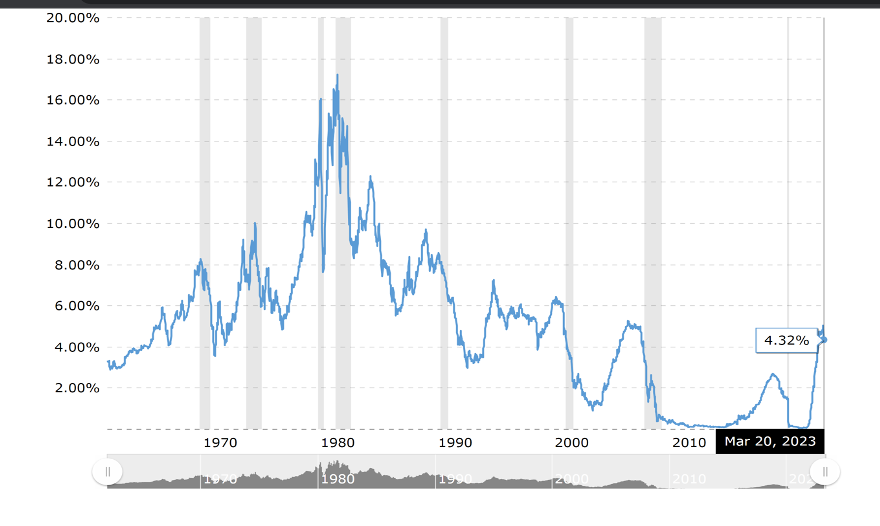

Yet one must worry that tougher days are ahead for housing, stocks and the economy in general. It appears to me that the current generation of political and financial leaders has lost its way. Sadly, fiscal responsibility does not win elections. At one time the Republican party stood for a balanced Federal budget. No longer. Social issues are now at the forefront of GOP talking points as these fire up the Base, not warnings of government overspending. At one time, we had a Federal Reserve chaired by a courageous leader, Paul Volcker, (appointed by Jimmy Carter!), who was willing to take the heat as he choked inflation down to a reasonable level by causing a recession. This contributed to forty years of low inflation and prosperity. Jerome Powell, the current Fed chairman grievously mistook a burst of inflation in 2021 as “transient,” waited too long to stop accommodating a burgeoning money supply and then slammed on the brakes by raising interest rates in a panicky reaction to persistent inflation numbers. Perhaps this is unkind – Powell had to deal with an unprecedented economic disruption caused by a pandemic. Just prior to the Covid disruption there were worries about a prolonged disinflation. Few expected supply chain disruptions and a European ground war. Still, those who’ve studied history should have, in my opinion, heeded the warnings of monetarist economists that inflation is the inevitable result of too much easy money flooding an economy. The brakes were applied only after a runaway train of inflation was rolling. See the chart below to realize that interest rates on safe investments like T-bills are the best since 2008.

A Sixty Year History of Interest Rates in the United States

Since my job, above all, is to protect client assets, I am happy to err on the side of caution. Most clients remain with an allocation close to 50% in “cash”, or as mentioned, money market mutual funds with decent yields. I see nothing objectionable in retreating to “cash” when the economy is at risk. Legendary pundit Martin Zwieg (mentor to Schwab’s Chief Strategist Liz Ann Sonders) famously advised “don’t fight the Fed” back in the 1980’s. The Fed is still raising interest rates, and we do not want to bring a knife to a gunfight.

In response to the deterioration in financial conditions last year, I first liquidated many stock positions, shifting into overnight money market funds whose yields soared to a level not seen in some fifteen years. Then, in March, as the mini banking crisis erupted, I chose to roll clients from an overnight money market[3], to a fund that holds only US Treasury bills. The idea here was to go ultra conservative, avoiding exposure to uninsured bank money market securities.

Clients are currently enjoying a yield above 4% with little risk. While I’m looking for more active alternatives, I’m not feeling any pressure from clients to jump into stocks here, and even if there was such pressure, I’m not likely to succumb to it. Compulsive trading is a losing proposition. Patience and deliberation win in the long run.

My goal is to earn a rate of return on clients’ money that is greater than the rate at which their buying power is being stolen by inflation. It’s a bit like a full bath tub. The past fifteen or so years have seen client portfolios filling up, but now accelerated inflation has opened the drain. While we are probably not achieving this goal at the moment, my hope and expectation is to fill the tub from an open tap at a faster rate than it is draining. I’m hoping to achieve this goal without the water becoming too hot or too cold.

Gary E Miller, CFP

[1] For an excellent overview of the situation read: https://commercialobserver.com/2023/03/default-floor-brookfield-blackstone-columbia-property-trust/ Note: many years ago, clients of Trusted Financial owned Simon Properties REIT, but most positions were sold at a profit and we’ve not felt comfortable returning to the holding. Bullet dodged.

[2] For a discomfiting overview of possibilities of default see the following article: https://www.theatlantic.com/business/archive/2013/01/heres-what-happened-the-last-time-the-us-defaulted-on-its-debt/267205/

[3] A typical money market mutual fund owns short term debt instruments such as Bankers Acceptances, Certificates of Deposit, Commercial paper and Repurchase agreements. These may expose money fund holders to some risk from bank failures.