“Without a boom, it’s hard to have a bust”-David Kelly PhD, Morgan Stanley

It was all smiles for investors in 2019, but despite the good news, we did not detect from our clients the emotional tenor that accompanies an over-valued bull market that is nearing a top. Roaring back from a fast but frightening fourth-quarter 2018 correction, both stock and bond markets had one of their best years of the past decade. Driving the market were growth stocks, especially Apple. Other technology favorites like Microsoft, Amazon and Google also shined. Our favorite cell phone tower companies, American Tower and Crown Castle did well and Mastercard profited from a strong consumer. 2018’s biggest loser, Dominion Resources, an electric and gas utility, rose to historic highs in 2019 while raising its considerable dividend. We’re pleased to have held on to this one.

The combined stock and bond rally came despite a cautious approach by our investors. The year began with a government shutdown, continued with the threat of a widening and costly trade war and ended with an impeachment of the president, hardly a climate to inspire confidence. Along the way, the tightening policy of the Federal Reserve that stalled equities in 2018, was suddenly reversed, and the Fed Funds rate was dropped three times. This gave the appearance, if not the reality that the Fed is providing a floor under the stock market.

Some prominent new issues like Uber, Lyft, Beyond Meat and Peloton retreated after their initial public offerings. This appears to demonstrate a healthy level of discrimination by investors that was not present during the tech bubble of the late 1900s. In that market, any new stock offering with “.com” in its name soared amid an orgy of speculation. Those who were burned by that bubble when it burst can take some comfort from this past year’s caution. Nevertheless, it was technology names, especially software and “cloud” related companies that appear to have been the primary drivers of this year‘s bull market. For example, Adobe Systems (ADBE), an early pioneer of the blade- and- razor model was a leader. Likewise, Microsoft (MSFT), which for the past four years has been driving consumers toward a subscription model for software, saw its share price soar some 60%. Apple was supposed to be yesterday’s news, under the theory that demand for smart phones has been satiated and that China would retaliate for the trade war. But iPhone 11 has proven a roaring success and the company wisely offers a free one-year subscription to its new Apple streaming service, promoting a rapid build-up for a recurring revenue driver. Further, Apple’s financial might has allowed it to buy in shares and raise its dividend consistently. This makes it appealing to a broad range of investors. Apple’s shares provided a total return of about 100%.

Long time clients know we favor the “value” approach to investing. This generally entails seeking out well run companies with low price-to-book or price-to- earnings ratios but also with “moat” type business models. Enterprise Product Partners (EPD) and Dominion Resources (D) are good examples. Yet our clients have been holding many technology names that have proven rewarding in 2019. Such companies have wide moats, bullet proof balance sheets and focused, talented management who have been leaders as markets change, not followers. Most importantly, their business models offer growing and recurring streams of revenue. That the market finds them attractive is confirmation of our approach. Through most of 2019 advances for the price of these issues was followed by mini corrections. We see this as healthy behavior, evidence that we are not in the midst of a blow off bull market. This does not appear to be the sort of wild speculative bubble exhibited by technology stocks from 1997-2000.

Those who dominate the financial world, Baby Boomer investors and their representatives remain keenly sensitive to the possibility of a surprise market collapse. They’ve seen those play out three times in their investing lifetime: 1987, 2001 and 2008. Margin debt, an indicator of speculative fervor has remained level these past two years, even as equity markets achieve new all-time highs.

The bullish price action was not limited to equity investors. Virtually all

fixed income instruments: treasury bonds, municipal bonds, junk bonds and

preferred stocks saw very healthy advancement. Still, bond market worriers have

been vocal. Among others, former Fed Chair Janet Yellen warned of deterioration

in credit quality. A record high portion of new corporate issues are

“covenant-light”. This means the corporate borrower can pile on debt without

having to pay down previous borrowings.

Demand for fixed income instruments is torrid. For example,

people are paying up for lower rated bonds so that the yield premium offered continues

to shrink to unattractive levels…yet this junk gets bought up by, in my

opinion, a careless set of investors.

It appears that investors are chasing yield and ignoring the risk presented to many of the issues when a recession arrives. I would submit that there may be another factor at work here: the so-called safe yield offered by treasury bonds no longer garners the same level of respect it held for over a century. The government of the United States is piling on debt at an obscene rate and there is no political will in Washington DC to slow this snowball. In 2011 Standard & Poor’s downgraded US Treasury debt from its historic level of AAA to AA-. After S&P had the temerity to speak truth to power it was lambasted by elected officials of both parties. Less than three weeks later, the president of the company was forced to resign. These are the same ratings agencies infamous for overrating many of the banks and mortgage backed securities that failed during the financial crisis. Can we trust any US based rating agency to say the obvious: US debt is of suspect quality. Even if the will to reduce debt and balance our federal budget were extant, there appears to be no way that the government can ever do so. That is the very definition of a “junk” bond. So perhaps the market demand for low rated corporate debt is simply a reflection of the lack of high-quality alternatives. This also explains my willingness to include preferred stock in the client fixed income mix. Preferreds do not provide the same theoretical level of safety as does a pure debt instrument. When chosen for client portfolios I first analyze the underlying company to determine its likelihood of remaining solvent. Our preferred stock choices have included those issued by several different banks and purchased in the nervous days immediately following the financial crises of 2007-2009. At that time, we were able to find very tasty yields for clients. One holding was a preferred issued by Deutschebank. It provided a total annual return of 10% per year until redeemed just a few weeks ago! This is the essence of value investing.

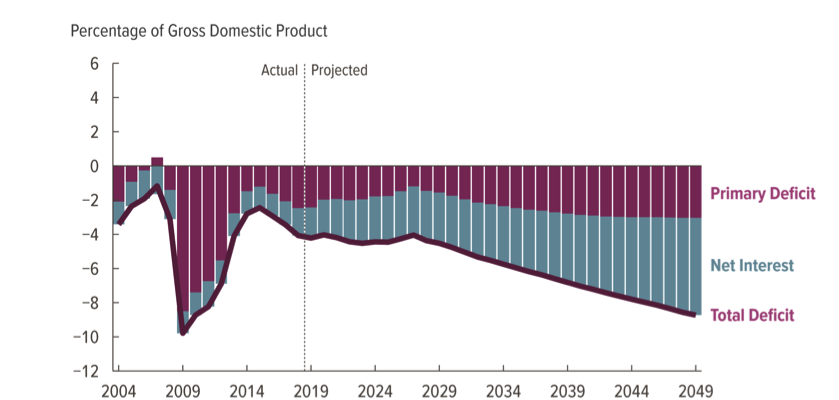

Apologists for the U.S. federal deficit frame it as a “percentage of Gross Domestic Product”. This makes the number, now in the $20,000,000,000 (twenty trillion) range, somehow more acceptable. The insidious thing about piling on debt is that, as with a household that cannot pay off its credit cards each month, the burden of interest begins to overwhelm. In the graph below, notice how projected interest on the national debt, shown in blue, becomes the largest cause of debt growth within ten years.

“Hard money” advocates have

been warning that unbridled borrowing will lead to an inflation crisis like

that which swept over Germany in the early 1930s leading to a collapse of

democratic government. When I began my career in 1974, I agreed with a book

that claimed we were on the verge of financial and monetary ruin.[1]

How wrong was this author! Somehow, developed economy governments have managed,

for decades, to maintain the fiction that government issued financial credit has

some sort of intrinsic value. So far, most people around the world behave as if

this is a given. Yet, 45 years into my career I’m again worried about the

soundness of our government’s credit. With the

advent of the Trump administration, Republicans, for whom fiscal responsibility was a sacred tenet, have approved legislation that appear destined to increase the federal deficit exponentially. This is to say nothing of the structural deficit for programs like Medicare and Social Security, both programs long known to be in the red. It may be that this time, the hard money advocates will be proven correct. When governments become insolvent one school of thought believes that it is smart to own “real” assets, not just paper promises.

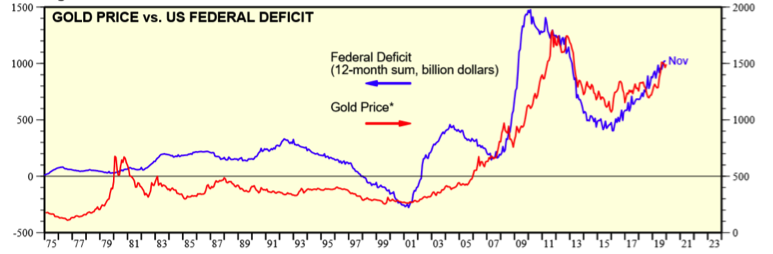

With this in the back of my mind I recommended gold for many client portfolios. This was also based on technical factors; the price having rapidly rose to its highest level in 6 years. Such moves usually telegraph that new money has come into an investment and that more will follow. Jeffrey Gundlach, a respected money manager began advocating for gold ownership during 2019. With the US deficits soaring, history suggests the future value of the dollar is under threat. There may be foreign interest in gold and other commodities as a counterweight to the US dollar. Recently it was revealed that Russia has been a buyer.

Another factor may contribute to the rise in gold and other commodities: artificially low interest rates. Some have theorized, and I tend to agree, that when there is little yield paid for holding cash (and the yield on money market funds is essentially zero), the attractiveness of other, non-yielding cash – like investments like gold improves. Gold represents a very tiny fraction of wealth held in the world, so even a very small shift by investors into this asset can have a disproportionate effect on the price.

Late in the year the market was boosted by optimism about a truce in the trade war with China and with our north American trading partners. The Trump administration, apparently anxious to lay claim to progress in reducing the in balance of trade with China prior to the 2020 election cycle, seems to have reached a modest agreement regarding increased purchases of agricultural products by Asia’s Tiger nation. While this agreement may help farmers in the Midwest sell more soybeans to China, it appears to leave the rest of the US vulnerable to continued spying and industrial theft by “China Inc.” On December 30, 2019 it was revealed in the Wall Street Journal [2] that Chinese domiciled hackers found a way to hide inside cloud servers holding personal and financial data on members of the US Navy, Deutschebank, Rio Tinto and IBM using “cloud hopper.” Apparently cyber warfare with China continues unabated.

What do we expect for 2020? The one factor that appears to be very supportive of financial markets is the resiliency of American consumers. Consumer purchases drives something like 70% of America’s gross domestic product. With unemployment at historically low rates it is difficult to envision the consumer tightening her wallet. Most observers expect our economy to continue to expand in 2020 at the historic rate of about 2% which appears to be the norm for our mature economy. As the year ended, financial markets appeared optimistic with all-time highs registered for major stock indexes. Even internationally oriented funds appeared to be turning north in value.

In the United States, we can expect some zigging and zagging of markets and of specific industries based on the outlook for the November elections. Some evidence for the underlying strength of our economy came in the second week of the new year. After a controversial assassination of Iranian and Iraqi officials from a drone strike, the equity markets bounced back quickly from an initial sell off. This seems to expose a very strong base of support for stocks.

Virtually

every financial person with whom I discuss the subject feels sure that given

the boom in financial assets under Donald Trump, he is likely to win

reelection. Wall Streeters may not love the president, but they credit him and

Republicans for creating a supportive climate for asset values. This is not a statement

of political advocacy, merely a reflection of what I’m hearing.

There is nothing unusual about the lack of

predictability we face today! I continue to recommend a healthy diversification

but also maintenance of at least 10% of wealth in short-term interest-bearing assets,

not exposed to equities. This may mean

leaving a little money on the table if the stock market continues to rise, but in

my opinion, this holding of cash is a worthwhile investment in a good night’s

sleep. Further, cash or cash-like

holdings provide the dry powder that will allow you to pounce on investment

opportunities when others are in a panic selling mode, should that opportunity

arise.

[1] “How You Can Profit from a Monetary Crisis” by Harry S Browne; copyright 1974 MacMillan Publishing

[2] https://www.wsj.com/articles/ghosts-in-the-clouds-inside-chinas-major-corporate-hack-11577729061?mod=hp_lead_pos5