“Trust in God, but tie up your camel” attributed to the Muslim prophet Muhammed

“Though April showers come your way, they bring the flowers that bloom in May” as sung by Al Jolson in 1921

Suppose I told you about an investment that could lose you money but has a 97% likelihood of being profitable? Would you consider this an investment with good odds of success? According to most health experts who have been observing the progress of the Corona virus (AKA “Covid 19”), only 3% of those who contract the virus die. Looked at another way, 97% of those who contract it survive. For the 8 out of 10 who become infected, the course of the illness, for people in good health, is relatively mild. While I have no desire to minimize this health challenge we face, I cannot but wonder at the extent of the equity market swoon it has prompted. The media, the markets and many in government, education and the entertainment world are reacting as if this were something out of one of those apocalypse movies. [1] Are they overreacting? Let’s examine.

Certainly, there are great challenges and unknowns ahead. In a matter of days, conferences and major sports events have been cancelled or deferred to a later date. The ripple effect of these decisions on hundreds of thousands if not millions of people employed in the travel, entertainment and service industries will be great and the psychological hit to consumer confidence has got to be debilitating to consumption, which drives 70% of the US economy. The possible cost of lost productivity and lost earnings is as yet incalculable and has investors spooked. The closest parallel within recent memory is the shock of the “9/11” attacks.

Medical science has not found a cure for viruses, only bacterial infections.[2] In conversation with a top infectious disease specialist who has been a client for many years, the statistics that I have heard were repeated: yes about 3% of those who contract coronavirus die but this specialist also confirms that 80% of those who contract the virus have only mild symptoms and thank goodness, children seem to be the most resistant age group. However, investors do not like uncertainty, and the possible destruction to be caused by an organism that has no known cure is an uncertainty.

The economic fallout will doubtless be vast. Demand for commodities was already sagging due to a slowing Chinese economy before the virus was identified earlier this year. With oil prices particularly vulnerable during a period of glut. Then, over the weekend of March 7-8, talks broke down between two of the largest oil producing nations, Russia and Saudi Arabia as they sought to control supply available to the world market. The Russians are notorious cheaters (with oil and just about everything else.) In exasperation, the Saudis announced they would increase production, no doubt with the objective of bending Mr. Putin to their will. Oil prices collapsed from the mid $40’s to the about $30/barrel. In less paranoid times, tumbling energy prices should be a reason to celebrate, as lower oil and gas prices improve profit margins for most businesses and save money for consumers, yet the markets did not care for the news at all. Stocks of major oil producers lost 30% to 70% of their market value and bonds and preferred stocks backed by energy related businesses were taken to the proverbial woodshed. Since energy is a major employer in the United States and we are now an exporter of oil and gas, this cannot be good for oil producing and refining regions but may otherwise be a shot in the arm for global business as a whole. In a frightened market, however, indiscriminate selling prevailed.

As a result of the rapid spread of Covid 19, an historic U.S. equities bull market that ran for 11 years appears to have ended. It is useful to remember, however that investors with balanced portfolios that include stocks are far wealthier today than they were just three years ago, just five years ago and certainly than 11 years ago.

Recent stock market behavior is being compared with the big meltdown of 2008 and even the panic of 1987. Having actively represented investors during both of those frightening events (and the Tech Wreck of 2000-2002), I can assure you that this too will pass. We know an economic valley is ahead of us (AKA “recession”), with pressure on equity values. Yet somehow, after panics, markets always seem to recover and then go on to greater profits. We tend to forget how desperately frightening past bear markets were but when in the midst of one as now, the fear is all too real.

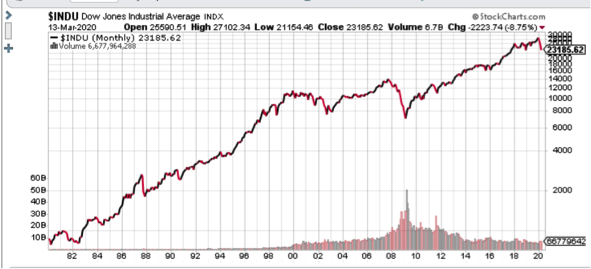

Take a look at this chart showing the well-known Dow Jones Industrial average going back to 1980:

I well remember the October 1987 crash. At the time it was likened to the “Crash of ‘29”, I considered a career change. Can you spot the price decline on the chart above? How about the “Tech Wreck” that caused so many do-it-yourself traders to postpone their planned retirement? The decline that really stands out for me on the chart is that which accompanied the Great Recession of 2008-2009.

There are good reasons to believe the coming recession could be less dramatic than that of 2008 and 2009.

- Unemployment is as its lowest level since the early 1960’s

- Household debt, especially mortgage debt is much lower than it was in 2007, relative to Household assets. Household net worth is up from $70.6TT in the 4th quarter of 2007 to $118TT in the fourth quarter of 2019.[3]

- The personal savings

rate is nearly twice that of the years prior to the Great Recession:

- Margin debt was not excessive going into this sell off, as compared to 2007

In other words, the overall financial condition of the economy appears healthy, which may allow consumers and businesses to weather this storm in better fashion than during the last crisis.

Certain investments that appear to be most threatened include lower rated bonds issued by certain oil drillers, airlines, and other service businesses (like hotels, restaurants or sports related companies.) Some preferred stocks could also be at risk. But and this is important, there does not appear to be the conditions that could lead to a systemic breakdown like that seen following the collapse of Lehman Brothers in late 2008. The Federal reserve appears to be providing liquidity and so far, the banking and insurance giants do not appear to be threatened. Thanks to more stringent banking regulations, stress testing and an improved culture among regulated lenders, the big banks have been more careful lenders and have larger reserves against loans outstanding than they did going into the 2007-2009 financial crisis. [4]

Long-time clients have ridden through market swoons with me before. We all know bear markets come out of left field. Surely, someone will be cited as a genius for predicting this sell off, but he or she will likely be the same person who predicted it in 2019, 2018, 2017…etc. However, no one is good enough to time the market. It’s precisely for this reason that your portfolio is diversified into non-stock holdings. Just last year when we had one of the strongest bull years in stock market history, most clients “underperformed” to the upside. Now, as long as stocks are weak and volatile, clients will likely “overperform.”

I continue to recommend holding companies with strong balance sheets, companies with a wide moat and companies where management owns a significant stake. This is not a time to gamble on “story” stocks (sorry Tesla lovers, sorry bitcoin fans.) Companies paying well covered dividends are also of interest, because as an investor, you are being paid to wait for a recovery in share values.

As worrisome as this growing epidemic appears, consider some perspective from history: the influenza epidemic of 1918 claimed millions of lives on every continent and yet society did not collapse, and financial markets recovered. In fact, over the 9 years following the end of the epidemic, the US stock market (Dow Jones Industrial average) rose seven -fold, from under 50 to about 350. I’ve never known anyone to be able to time exit and entrance points for the stock market, and odds are you are no exception to the rule. Thus, if you are not going to need to get at your money for a major expense, it would likely be unwise to exit sound investments in a panic.

Is a bottom near?

Consider that for every stock sale there is a buyer. Markets continue to function, matching sellers with buyers. This means that somebody thinks there are bargains around. These folks usually are so-called “value” investors, the most famous example of whom is Warren Buffet. He is often quoted for saying “when others are fearful, be greedy, when others are greedy be fearful.” In other words, panicking sellers tend to give away high quality stocks at incredibly cheap prices. Successful long -term investors have to be willing to nibble at such bargains when they suddenly appear.

Here are three interesting examples from March 12, 2020: Exxon Mobil (XOM) -this company has paid a dividend for decades and has raised its dividend each year for the past 20 years. It is one of the few companies with a “AAA” credit rating. The current dividend yield is over 8%. Another is Kimberly Clark (KMB), currently yielding 3.50% and has paid and raised its dividend every year since 1997 (and with an apparent panic to own toilet paper, one has to believe that dividend is safe!) Then there is Clorox corporation (CLX), maker of disinfectant and cleaning products. Clorox has paid and raised its dividend every year since 2003 and is currently yielding 2.50%. THESE ARE NOT BUY RECOMMENDATIONS, MERELY EXAMPLES OF COMPANIES THAT HAVE FALLEN IN PRICE AND NOW OFFER ATTRACTIVE INCOME, THE KIND OF SITUATIONS A VALUE INVESTOR MIGHT FIND INTERESTING.

Do these examples mean it’s time to back up the truck and begin buying stocks? Has a bottom been reached? Probably not yet. While I’ve received “worried” calls from a number of clients, a capitulation mentality does not appear to have yet set in and the market is not dirt cheap. I agree with pundit Jim Cramer that until the average price -to- earnings ratio (PE), for the Standard & Poor’s 500, currently at about 15, approaches the lows of the last correction, in late 2018 at about 13 we will not have a meaningful rally. Still, let us not forget that the PE low during the financial crisis of 2007-2008 was (gulp)…9. It may be possible that the recession into which we are heading may equal that of the 2007-2009 crisis, so maintaining a cache of “cash”[5] is recommended. Cautious buying (I like to call it “nibbling”) is the only approach with which I’d feel comfortable at this time.

In the meantime, please be assured I am carefully watching

the performance of your holdings and will make adjustments as necessary.

[1] On March 13, 2020 the New York Times cited an unreleased presentation by the U.S. Centers for Disease Control (CDC) suggesting that 160,000,000 to 214,000,000 Americans could be infected, and deaths could range from 200,000 to 1,700,000. (“Worst-Case Estimates for U.S. Coronavirus Deaths” March 13, 2020 www.nytimes.com)

[2] Antibiotics appear to work for many bacterial diseases and Tamiflu seems to be effective in shortening the course of influenza type A and B if taken within 48 hours of contraction. But according to a review at www.wikipedia.org, many health organizations believe it carries its own set of risks.

[3] Source: Board of Governors of the Federal Reserve (https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/chart/)

[4] Still, if defined benefit pension plans, mostly enjoyed by public employees, see their balances reduced in the new bear market, this implies financial strain and still higher taxes for those states that have over promised: California, Illinois and New York come to mind.

[5] Out of an abundance of caution, a money market fund holding only US T-bills, or direct ownership of US T-bills is the safest place for cash like holdings.