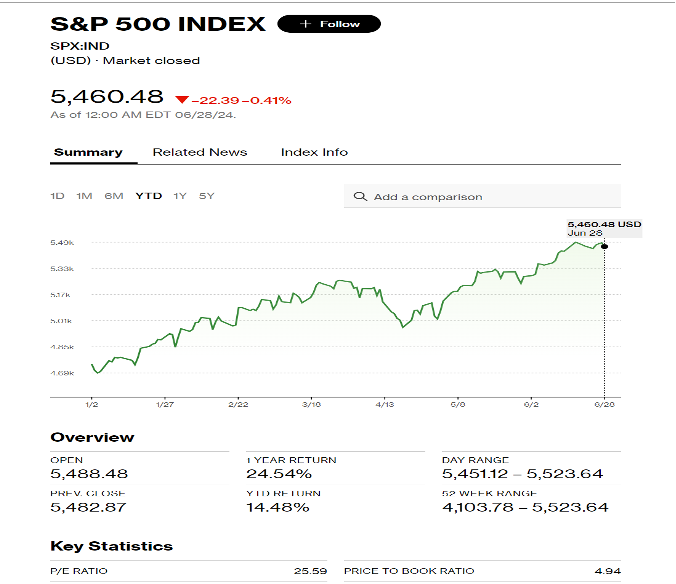

As the chart below shows, this has been a good year, so far, for the broad Standard & Poor’s U.S. stock index. Driving this performance has been a handful of powerful technology issues. Absent these companies, the index’s rise would have been OK but nothing to get excited about.

Fortunately, most clients owned the technology darlings, like Nvidia, Microsoft and Apple either directly or through mutual funds.

Source: Bloomberg.com

Although I strive to be a value investor, a significant holding of companies trading at seemingly high price earnings ratios would seem to belie this moniker. The definition of what a “value” investment is has always been, in dispute. The companies that compose the U.S. stock market are far different than those of the 1930, ‘40’s, ‘50’s and even ‘60’s when Value investing was codified by the likes of Ben Graham and Warren Buffet. In those days, valuation was often based on dividend payout levels. Today, a time when technology dominates the indexes, few technology companies pay high dividends. The better ones have a high level of free cash flow or “cash flow yield.” This and other metrics like price to earnings price to book value help me choose what I believe to be good values. Your holding of some highly successful stocks was not the result of following but rather an attempt to stay ahead of the Crowd. Companies like Nvidia, Broadcom, Amazon, Microsoft, and Apple have risen in price to the point where their percentage dividend yield is tiny. Yet many of these companies enjoy a gusher of free cash flow. The management of these companies directs that cash not just to raising dividends, but also to buying back stock, which supports or drives share price higher. Often, free cash is used to acquire or invest in complimentary businesses. If management does a good job of acquisitions, this may well be better than sending funds out to shareholders.

Example: beginning in 2019, Microsoft made a $13 BB investment in a little known start up called “OpenAI” that, in late 2022 launched “ChatGPT”, artificial intelligence for the masses. This, the first practical Artificial General Intelligence engine has taken the world by storm, and Microsoft has a nearly exclusive ability to incorporate Chat’s AI engine into its popular applications, like Word, Excel, Teams and PowerPoint. Microsoft’s cloud platform, Azure, is exclusive host to ChatGPT, and this may attract others to park their software on Azure, to reduce latency. Azure is a cash cow for Microsoft, and it’s safe to say that the $13 BB investment in OpenAI was smart use of cash by Microsoft management.

Choosing when to buy, hold or fold has always been something of an art. In the current era, when technological innovation is invading everything from drug discovery to running a restaurant chain, to conducting war, it is tempting to bet the farm on popular technology darlings. But tech company stocks can be very volatile. So, our clients also own mundane income producing bonds and preferred stocks, usually paying high dividends. These instruments smooth month-to-month portfolio volatility. As often stated in these reports, I see my primary task as avoiding or at least reducing loss of portfolio value during tough times. This usually means you will underperform the indexes in good times and retain value when the chips are down.

At the moment, our tech holdings are doing very well for us. But my 50 years of experience tell me that things will not always be this sanguine. A couple of quarters of slowing earnings, and the Crowd may quickly abandon today’s most popular stocks. Witness Amazon (AMZN), which we owned profitably from early 2016 until early 2022, but which sold off in early 2022 as interest rates rose and bottom line income was siphoned off by expensive capital investments. As the shares cascaded downward in stair step fashion, and gave worrisome technical alerts, I took profits in stages. Jeff Bezos semi-retired in 2022, to focus on his space venture. Under CEO Andy Jassy, Amazon is now focusing more on profit margin, rather than headlong expansion of top line sales. As a result, the company has recently shown a few quarters of consistent growth in profitability. The company seems to have regained its footing and a technical buy signal encouraged me to re-invest in the stocks with a modest 3% purchase for appropriate clients during the last week of this recent quarter.

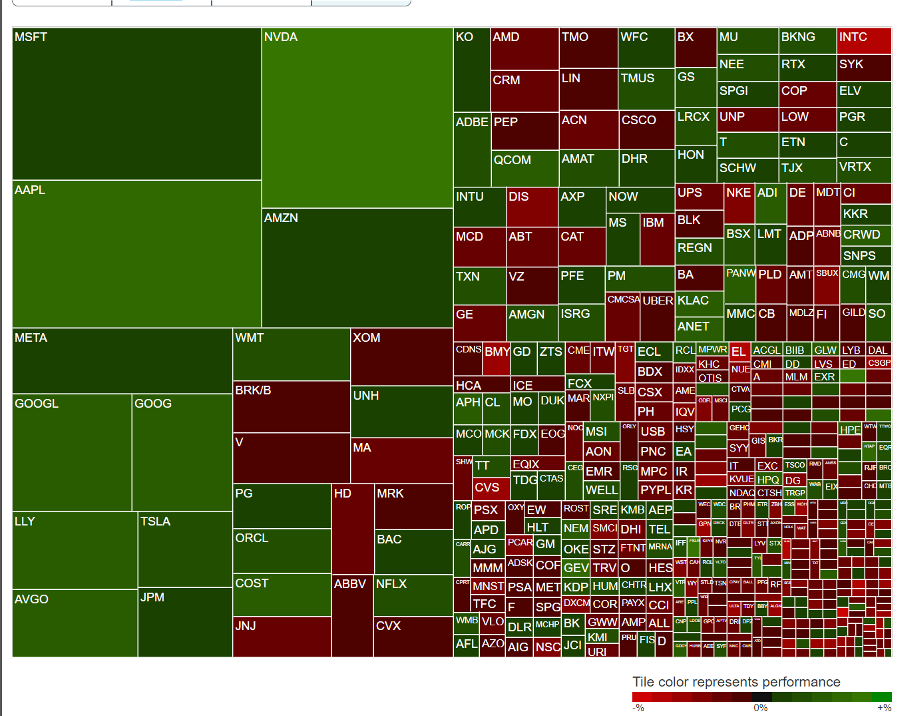

Who Performed, Who did Not

Below is a so-called “heat map.” This illustrates the performance of specific stocks over the recent quarter. Green indicates an equity that was up in value and red a stock that was down. Size indicates the degree of share price change.

This graphic illustrates how important was stock picking. Some stocks or funds that struggled, such as AbbVie, McDonalds (MCD) and Vinci (VCISY) were sold during the recent quarter. Each had unique challenges. A brief foray into the world of emerging market bonds was closed during the quarter with a small loss. I try to let the winners run and to be willing to back out of situations, relying on technical signals for timing. Naturally, there will be both losers and winners in a given time period.

High yielding preferred stock purchased in recent years have been winners. Sadly, we were forced to surrender preferred stocks of Nustar and Energy Transfer partners sporting yields of 7% or better as they were called (“redeemed”) by their issuers. Preferred stock has been a consistent presence in many client portfolios. Their yields are usually well above those of common stock or even long term bonds. They are not an appropriate tool for huge money managers, due to the fact that preferreds trade on relatively slim volume. But they work for clients of Trusted Financial because as a boutique operation we can buy such instruments without having to compete with gigantic investment companies.

I made a foray into international shares with investments in India, Japan, and a European infrastructure stock. We also briefly held an emerging markets bond fund. Generally, foreign stocks trade at lower multiples than U.S. issues, which is seductively appealing. Results were mixed. I decided to abandon Vinci (VCISY), the French toll road and construction firm as it suffered along with other French issues due to an impending sea change in politics there. Likewise, Vanguard Emerging Markets Bond ETF (VWOB) was sold with little damage: I bought this fund believing that as US interest rates fell, so would the dollar relative to high yielding foreign bonds. As the year advanced, I came to worry that the persistent strength of the U.S. dollar was an insurmountable depressant.

Indian stocks are replacing China as the new favorite for those seeking Asia exposure, like us. India has a corruption problem but is less of a risk than the twisted thinking of the anti-business communists wreaking havoc with China’s economy. Here is a graph of the India focused mutual fund in which many clients are currently invested:

Source Stockcharts.com

Energy holdings

Our investment in the energy space has not been as exciting as technology this year with the exception of Oneok (OKE). We owned Magellan Midstream partners, and it was acquired to Oneok in late 2023. The decision was made to hold the combined company, and this has turned out well so far -witness Oneok’s performance since the merger:

Clients have held energy related companies for decades, and this will likely continue. Although the world is steadily adopting new sources of energy, petroleum based fuels remain dominant. Further, a huge array of chemical compounds is derived from oil or natural gas. Upstream exploration and production companies such as Coterra (CTRA) and Devon (DVN) have earnings that are closely related to the price of oil and gas, in other words, they are cyclical. So far, their performance has been soft this year, but their decent dividends continue to flow. Unless clear signs of a recession begin to develop, I plan to hold these for the longer haul. Both companies own attractive acreage in major U.S. producing regions and are among the most efficient drillers and producers. As their performance does not correlate closely with other portfolio holdings, they can both smooth performance and generate reliable dividend income

Pundits, like my favorite economist Edward Yardeni, are noting that while a small group of popular technology giants, the so-called Magnificent Seven, have pulled broader indices higher, there is but tepid breadth – in other words the majority of S&P 500 shares have been mostly treading water. Only about 70% of stocks are higher than they were at the beginning of 2024. Comparing this to the peaks in past years (see graph), I conclude we are not in an overvalued stock market.

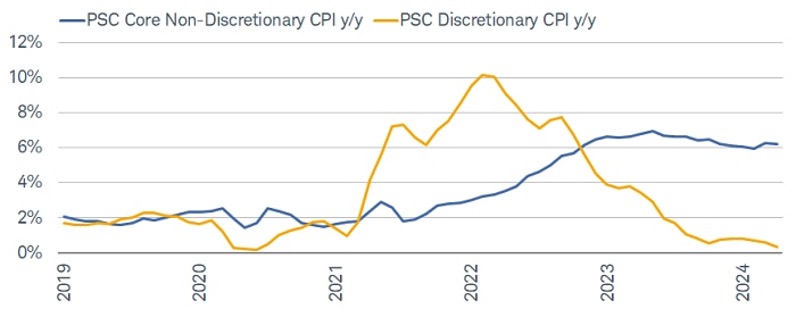

Inflation seems to be trending back down toward the 2% annual goal set by Federal Reserve Chairman Jerome Powell. Goods inflation has moderated significantly with the end of supply chain bottleneck. Service inflation remains stubbornly high, as anyone who books a hotel or eats at a restaurant can attest. One or two more good inflation reports, and the Fed may lower short term interest rates a bit, but the optimistic expectations from the beginning of 2024 have evaporated. Further, with the cost of shipping soaring higher[1], goods price inflation may haunt the Fed as we get further into the year.

Schwab’s Chief Economist Liz Ann Sonders posted the chart showing how inflation remains elevated for non-discretionary spending on insurance, health care and housing.

Source: Charles Schwab & Co Inc

However, it appears demand for labor is softening a bit, and the economists I follow believe the Fed is more afraid of softening labor demand than inflation. This may tip the scales toward one or two rate cuts in the near future. If rates are actually lowered, it could motivate folks holding money in overnight money market funds or CD’s, currently paying over 5%, to shift a bit more into equities. This would add a meaningful upward leg to the market.

In summary, the usual mixed signals and a possible sea change in Washington make investing a challenge. We have returned to a Cold War footing. Protectionist thinking in D.C. is ominous. Globalization, an important factor in the thirty years of low inflation we once enjoyed, is apparently dead. Central banks around the world may be forced to maintain higher interest rates for longer than markets can tolerate. This is why, despite recent success, I’ll continue to insist on diversifying your holdings in an effort to reduce downside risk while attempting to capture most of the upside.

As always, please feel free to contact me with any questions regarding strategy and to keep me informed of your specific needs and objectives.

Gary E Miller, CFP

[1] Houthi rebels are shelling containerships in the Red Sea/Suez Canal transit zone and the Panama Canal has slowed due to low water levels. As a result, container ships are using routes around southern Africa and South America that has send shipping costs skyrocketing.