A Cold Wind in August – 2015

Over this past weekend, I shared a special report with clients, discussing with some detail their current holdings and explaining our approach during this time of equity (stock) market correction. Below is an edited version for use by the public: The US is basically being pulled down by the rest of the globe, in particular the Chinese equity markets which [...]

Mid-Quarter Update – August 2015

Bow Wowwwww! They don’t call it the “Dog Days” for nothing. Imagine being a pooch in summer, wrapped in a fur coat in the days before air conditioning? This pretty much describes the behavior of most stocks during the summer. Trader’s desks are empty, clients are enjoying the beach, or cruising in their yachts (big time investors all own yachts, [...]

TFA Letter to the Department of Labor

On April 16, 2015 I posted an article about conflicts of interest exhibited by many who advise retirement plans. The value of retirement assets owned by U.S. plans and savers is something north of $21 Trilliion. The latest figure I've found was from 2013, at $20.8 TT and the equity and real estate markets have risen considerably since then, while [...]

One of My Favorite Charts

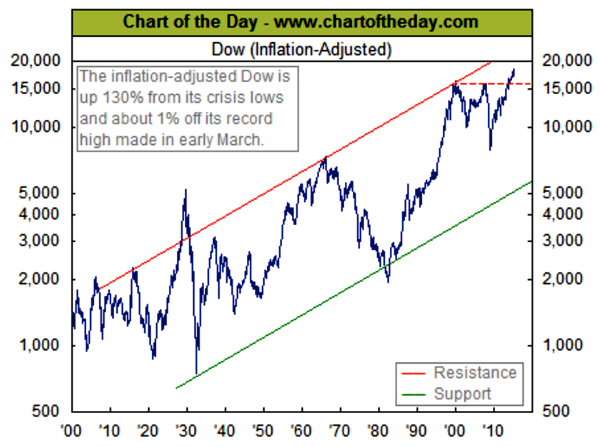

The inflation adjusted Dow or similar “inflation adjusted” measures of performance

remind us that earnings and returns on investment, in the end, are about what you can

buy with your profits. As the cost of living rises inexorably, we all need to generate

greater dollars to maintain and hopefully improve our wealth.

We hear of “record” levels for stocks, from time to time but without adjusting for inflation

this is as deceptive as comparing Elvis Presley’s 1956 earnings to those of Taylor Swift

in 2014. So the chart below is one I like to check from time to time, as it tells us if

markets are truly making progress for investors over longer time spans.

As I noted here last year and at our annual client event, this chart should get a true

“technician” excited. Any asset class whose real level is able to exceed the level that

has held it in check for some 13 years is usually sending a strong continuation signal.

Recommend Real Estate in your Portfolio

I recommend this article to anyone thinking of buying individual property as an investment. We've used real estate investment trusts in our client portfolios for many years with good results. The nice thing about REITS is they allow the investor to exit rapidly rather than becoming entangled in the often lengthy process of negotiations with a limited number of buyers a problem that characterizes ownership of individual properties. Even better, the investor avoids the hassle of property management.

"Why Real Estate Should Be in Your Portfolio" Barron's | Jan Willem Vis Investors who have been inclined to dismiss listed real estate as an attractive asset class since the financial crisis should perhaps reconsider, as they could be missing out on the important roles that listed real estate can play in multi-asset portfolios. Not only can it operate as a proxy for direct real estate while generating diversified returns - with a stronger income component arising from high dividends - it can also provide some protection against rising interest rates, which may come as a surprise to some. Evidence shows that, over the long term, investment in listed real estate offers an exposure to direct real estate (including real estate physical property investments and unlisted funds) while addressing the well-known illiquidity problems associated with owning a portfolio of individual buildings. Read More

Retirement Advisors Conflict-of-Interest Rule

While I've not read the Dept of Labor proposal, on the face it appears to target conflicts of interest that troubled me until deciding to become a "fee-for-service" financial planner at the end of 2000. My company, Trusted Financial Advisors has never been financed through commissions, hidden 12b1 fees or the like. This is still relatively rare in the financial [...]