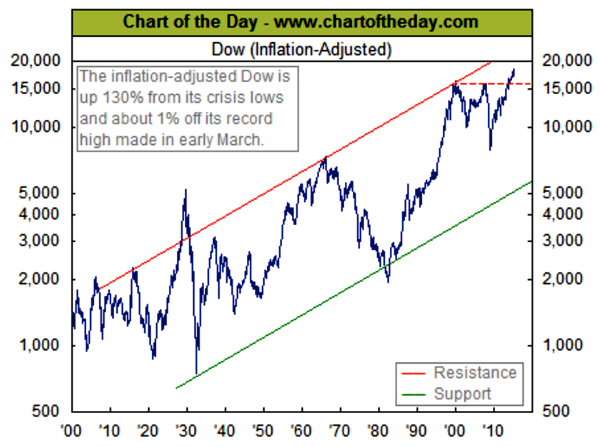

The inflation adjusted Dow or similar “inflation adjusted” measures of performance

remind us that earnings and returns on investment, in the end, are about what you can

buy with your profits. As the cost of living rises inexorably, we all need to generate

greater dollars to maintain and hopefully improve our wealth.

We hear of “record” levels for stocks, from time to time but without adjusting for inflation

this is as deceptive as comparing Elvis Presley’s 1956 earnings to those of Taylor Swift

in 2014. So the chart below is one I like to check from time to time, as it tells us if

markets are truly making progress for investors over longer time spans.

As I noted here last year and at our annual client event, this chart should get a true

“technician” excited. Any asset class whose real level is able to exceed the level that

has held it in check for some 13 years is usually sending a strong continuation signal.