Portfolio Update

March 6, 2021

Over the last few trading sessions, I advised exiting or reducing four profitable holdings found in “Active” client accounts. These were Equinix (EQIX), American Tower (AMT), Zoetis (ZTS) and Adobe (ADBE). These are companies in relatively unrelated industries, with attractive fundamentals for the long term.

The selloff appears puzzling: with optimism around plummeting cases of Covid 19, such a sell off does not appear to make sense. Happy Days are (almost) Here Again, right? The selloff so far is focused on tech stocks that were boosted by the “Stay-at-home” economy, but others appear vulnerable as well. Money seems to be rotating out of such names and into Covid Recovery names. Another, perhaps stronger force also appears to be at work. the so-called “Bond Vigilantes” have ridden into town, unhappy with an enormous new spending plan that will balloon our nation’s debt burden without question. The government will be funding this with a firehose of Treasury bond offers. Investors are suspicious, especially those who believe no government can fund itself by borrowing forever. Rising interest rates are challenging for stocks because bonds, considered safer than equities, offer an alternative for investor savings.

The Ten year Treasury bond has nearly tripled in yield since its mid-2020 low point. Despite remaining near historic lows, certain investors clearly have been unnerved and are taking stock profits or shifting money to bonds. I don’t pretend to have a complete grasp of all the macroeconomic forces at work here, but we have responded to the technical signals of certain holdings as they are received.

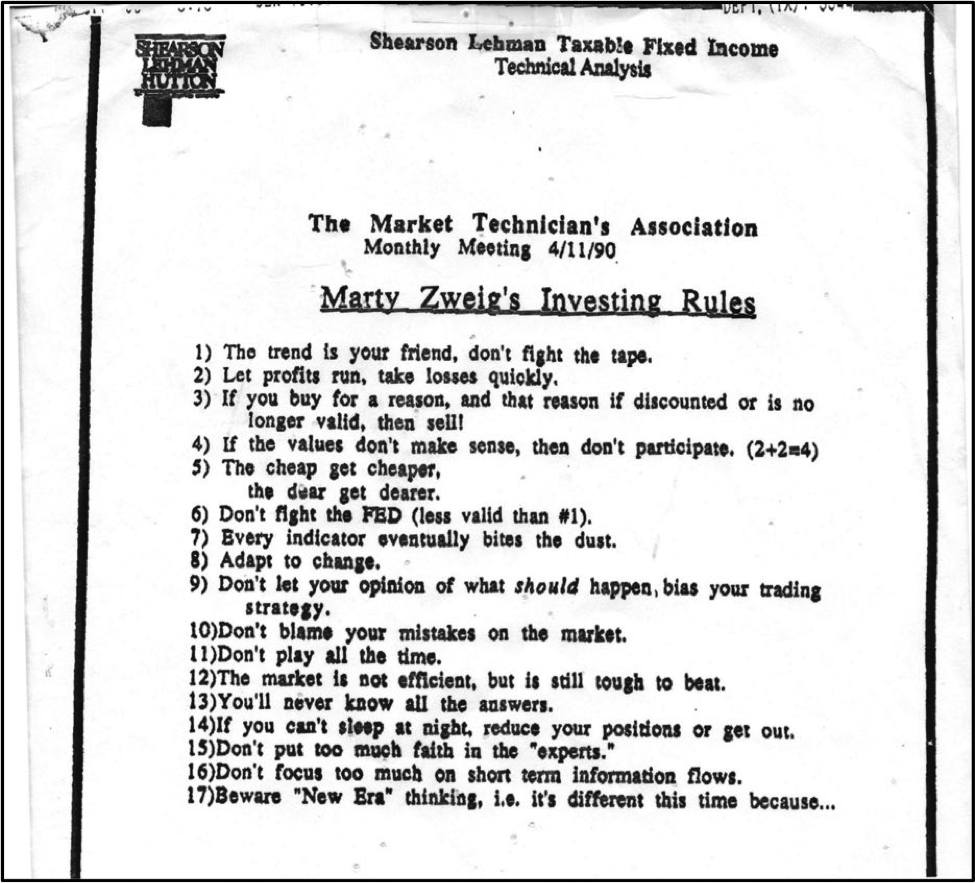

As attractive as each of the sold company’s story may be, when the shares of even a good company crash through important price support levels (a level where the market or a particular stock stalled, backing and filling on its ascent), it calls for attention. The reason for this weakness is as yet not clear, but experience has taught that such dramatic price changes are often based on actions taken by traders with knowledge that is superior to that of the general market (which may be inside information). The late Martin Zwieg had an oft -repeated admonition: “don’t fight the tape”.

From a bygone era (note the letterhead), timeless advice.

Zwieg, who, by the way, mentored Schwab’s Chief Strategist Liz-Ann Sonders, was referring to the Wall Street machine of old, the ticker tape, which was a telegraphic real time flow of prices found in stock brokers’ offices. What Zwieg was saying was that while we never have perfect information, price changes for stocks reflect the collective beliefs of thousands of traders and may signal a warning even when we may not be able to articulate the precise cause. Once such a signal is received, we try not to engage in wishful thinking, we try to put emotion aside and obey tech signals that clearly suggest that a meaningful change in direction has happened. Warren Buffet has stated in his famous Letter to Shareholders that Rule # 1 is “don’t lose money”. Rule # 2 is “don’t forget Rule #1”.

For this report, I’ll focus primarily on price action (Aka “TECHNICAL INDICATORS”) with less emphasis on speculating as to the fundamentals that may or may not have sparked this price retreat.

Two of last week’s sales were Real Estate Investment Trusts (REITs). Since REITS are often favored by income investors for their relatively high dividend payout, a rise in competing bond interest rates is a threat. Objectively, U.S. Treasuries at 1.50 to 1.60 % should not be much of a threat, but that’s not what these REITs seem to be telling us. I think some REIT investors anticipate still higher competing yields from Treasury and corporate bonds.

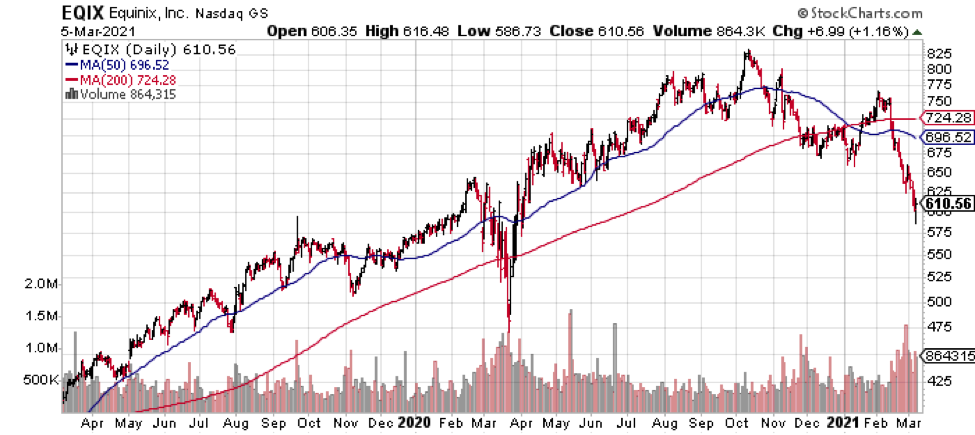

Equinix

Arguably the premier REIT benefitting from “Cloud” computing adoption, Equinix seems to be enjoying an insatiable need for remote servers and for interconnection. As waves of businesses move data and processing operations off campus and begin relying on cloud computing, Equinix’s top and bottom lines have surged. If money seems to be leaving Tech and moving into so- called “reopening” plays, one might expect a flattening of price action for this industry, even some downward pressure. But this recent, dramatic break below key support levels, on high volume, is alarming. EQIX appears to offer a textbook example of a stock that has declined out of a consolidation of many months’ time. This has been accompanied by a likely “Head -and-Shoulder” top pattern that suggest the current sell off is serious and will be of duration. Volume is often a tell that larger investors (supposed to be “in-the-know”) are voting with their feet. In the chart below, notice how volume spiked as the stock broke below its important 200 day moving average (red line).

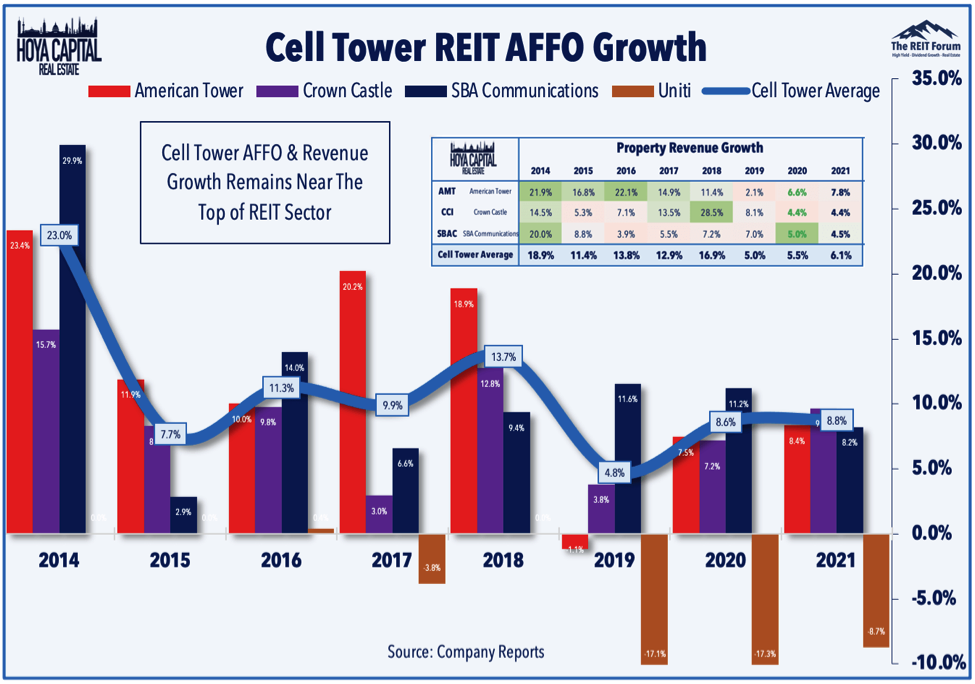

American Tower,

First purchased in 2013, AMT has ridden the expansion of wireless voice and data transmission. However, the stock has been looking sickly for some time. Their story is a good one: with limited competition, they rent space on their cellular phone towers throughout the USA and abroad. Unless a new technology can compete with or replace the current cell tower configuration[1], American Tower appears to enjoy something of a moat around their business. Yet their growth and bargaining power appears to be under threat with approval of the merger of T-Mobile and Sprint, apparently reducing demand for tower space in the United States[2]. A similar thing happened to AMT in 2019-2020 in India, as mergers allowed surviving cell phone companies better bargaining power with regard to what they pay for tower real estate. The company was belting out double digit cash flow, also known as “Available Funds from Operations” (AFFO) until a slowdown became evident in 2019. But, as the graphic below illustrates, AFFO has drifted lower for the two top Tower REITS and is relatively flat for the third major, SBA Communications (SBAC). It appears the tug of war between towers who sell space and cell phone system operators who buy space is swinging a bit more in favor of the operators.

Back in October I recommended a position reduction when AMT fell through its 200 day moving average. A Significant amount of money was taken off the table in the $235 range. An attempted rally early in this quarter has since failed. With the price breaking below temporary support seen at about $215/share it was time to grab the rest of our chips off the table. Most clients bought AMT at a cost basis in the $75 to $85 area, so I doubt we will hear any complaints except, perhaps at tax time.

By the way, we had a few people in tower competitor Crown Castle (CCI) and these positions were also sold.

Zoetis

Zoetis was spun off from Pfizer about nine years ago. They develop and market medicine for animals. Demand for therapeutics for both companion animals and production (livestock) animals is healthy. Zoetis is pioneering effective treatments, and a widely recognized brand among veterinarians. Some who believe in the stock note that unlike pharmaceuticals made for humans, animal medicine is not subject to the bargaining power of insurance companies or Medicare/Medicaid. This is considered an asset as Zoetis is freer to raise prices than might be the case for a human pharma company who may have to justify reimbursement to state and federal insurance plans and to private insurance companies.

While we were attracted to the secular bull market for animal pharmaceuticals well before Covid -19 emerged in early 2020, Zoetis enjoyed an extra boost during the pandemic-induced shut down. People isolated from fellow humans sought companionship from dogs and cats and demand for them rose strongly. This led to an expected spike in demand for diagnostics and pharmaceuticals for animals. This story may be stalling as investors contemplate the approach of societal re-opening. For Zoetis this could mean a flattening or even reduction in pet adoptions and a concomitant drop in expectations for future earnings growth.

As with Equinix, the “sell” recommendation for Zoetis is the result of technical behavior – a break below consolidation and down through a previous low of $152, plus a fall through the 200 day moving average on good if not heavy volume.

For now, another suspect stock is Adobe Systems (ADBE).

As with American Tower last October, a reduction in certain client holdings was suggested last week. The Adobe chart makes for worrisome reading. Not only did the stock fall below the 200 day moving average but the 50 day average, in blue, looks as though it may cross down through the 200 day. Some technicians take that as a definitive sell signal, so should that occur, there could be yet another wave of selling for the stock. Obviously, this bears watching.

Conclusion

As society begins re-opening, money appears to be flowing into re-opening plays: Banks, Travel & Leisure, Energy. This is a reasonable rotation. As interest rates surge, investors also appear to be exiting certain stocks, especially those whose appeal is to income investors like REIT’s.

However, the power with which the holdings discussed here saw prices erode suggests something darker may be afoot. I’m holding my breath on some of the FAAMNG names. If they crash through their technical floors this could get ugly for the entire equity market.

We’ve managed portfolios through some pretty dark periods. When exiting positions, this is usually done on a case-by-case basis. However, when enough market leaders experience a price break down, we are usually well on the way to a generalized equity bear market. Today, the major indexes are achieving record highs, so the weakening of some very good companies gives pause. We are watching.

[1] Some skeptics suggest 5G technology which requires large numbers of mini cell sites will steal momentum from large tower companies. Elon Musk is working on a satellite based phone system.

[2] Dish was awarded spectrum and other concessions as part of the FCC and FAA approval of the Sprint/T Mobile merger, and is expected to enter the cell phone competition over the next three years.